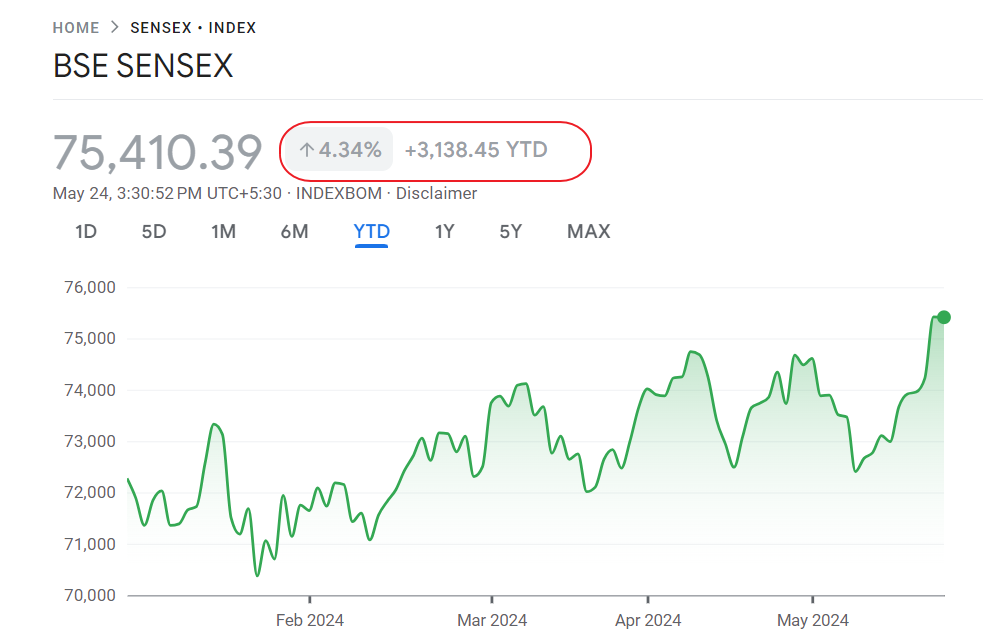

The Indian stock market was one of the best performing markets in 2014 with a return of nearly 30% for the Sensex in local currency terms. This followed a 26% return in 2012 and 9% return in 2013 respectively. Year-to-date the index is up by 6.60% as of Feb 18th.

Andrew Graham of Martin Currie,UK warns investors that its time to sell the Indian market. From an article in FE Trustnet:

The recent dominance of Indian stocks in emerging markets won’t last following a divergence between valuations and fundamentals, according to Martin Currie’s Andrew Graham.

Indian equities rocketed up in 2014 as increasingly positive investor sentiment flowed towards the country after the election victory of the pro-business reformist Narendra Modi in March.

Voters handed Modi a landslide victory, after he promised the country a series of reforms mostly aimed at stimulating its economy and tackling corruption. He pledged to restructure a multitude of protectionist and tax policies that have stymied the flow of foreign capital into the country over the past decade.

As a consequence, the MSCI India index was the standout performer in both developed and emerging markets last year, having gained 31.58 per cent. The next best performer of the major indices was the S&P 500, which gained 20 per cent. Meanwhile, the MSCI Emerging Markets index made just a 3.9 per cent gain.

The Indian market has continued to rally in 2015 bringing its total gains to more than 50 per cent over the past year.

But Graham, whose remit includes the Martin Currie Asia Pacific Trust and open-ended Martin Currie Asia Pacific fund, says investors may wish to shift away from Indian exposure to avoid a sell-off in the near term.

“Everybody loves [India]. 18 months ago there were huge discounts available in stocks relative to their long-term averages but nobody was interested,” he said.

“Now, I see a lot of quite cyclical businesses in India to me that are no better than Chinese companies and are trading on many, many times multiples while their Chinese counterparts are not.”

“There is nothing wrong with Indian companies but there are very serious questions about valuations. The underlying change is for real but a lot of the really positive changes going on there are not really going to appear as economic growth or corporate profit growth – maybe later on but it is going to take time to come through. You’re not going to flick a switch and it will happen.”

Source: Time to sell last year’s best market, warns Martin Currie, Feb 19, 2015 FE Trustnet

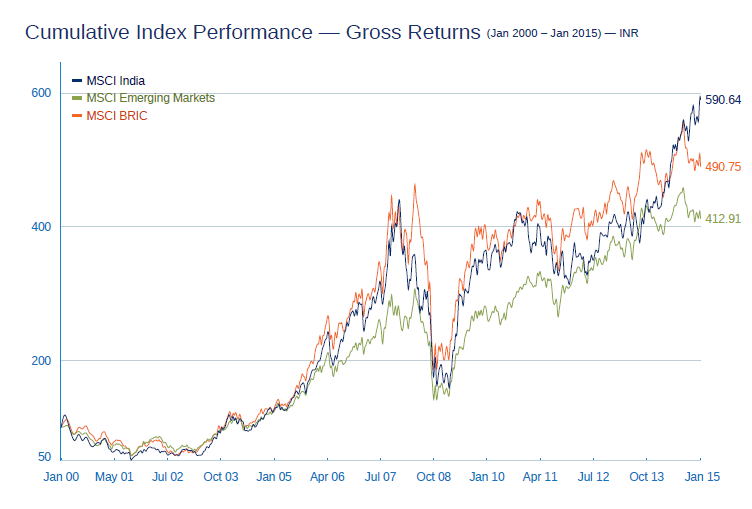

The following chart shows the performance of the MSCI Index relative to the MSCI BRIC and Emerging Markets indices since 2000:

Click to enlarge

Source: MSCI

The S&P BSE Sensex closed at 29,446 yesterday which is within striking distance of all-time highs.At current levels, Indian stocks have a P/E ratio of 18.52. For the MSCI Index, the ratio stood at 19.87 at the end of January. Currently the P/E ratio of MSCI India index is much higher than the Emerging markets and BRIC indices.

Since the Indian economy is not growing at a faster pace as in the past and stock prices are already at elevated levels, investors may want to be cautious before committing new investments. Global investors are avoiding Brazil, Russia and China and instead ploughing their funds into Indian equities. Much of the equity price rise has come from the flow of foreign cash as domestic investors especially retail investors are stay away from the equity market. So unless corporate earnings can grow at expected rates, it will be difficult for the market to sustain current equity prices.

Some of the India-focused ETFs are PowerShares India (PIN), iShares S&P India Nifty 50 (INDY), iShares MSCI India ETF (INDA), etc. The list of Indian ADRs can be found here.

ETFs: The Complete List of India ETFs and ETNs Trading on the US Markets

Disclosure: No Positions