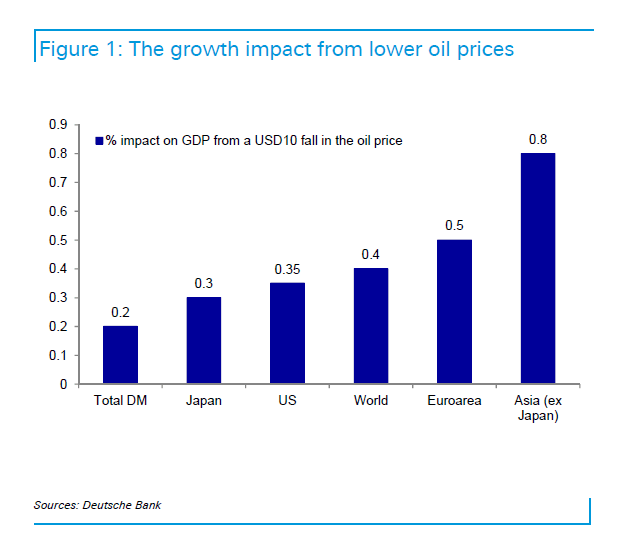

Oil prices have fallen to a four-year low and continue to fall with prices closing at $86.44 per barrel(Brent) yesterday for December delivery. One way to profit from lower oil prices is to invest in emerging market equities as they are major oil importers. According to one Deutsche Bank research report, Europe & Asia (excluding Japan) are projected to be the biggest beneficiaries from a growth perspective.

From the DB research report:

We estimate that a USD10 fall in the oil price with boost growth in Europe and Asia by 0.5 and 0.8 percentage points respectively.

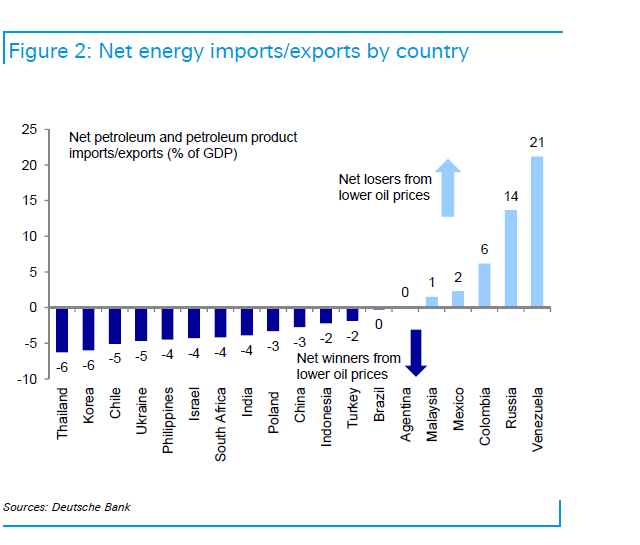

From a trade perspective, Thailand, South Korea, Chile and the Ukraine will benefit most. Meanwhile Venezuela, Russia and Colombia will suffer on a relative basis given the large share of petroleum and petroleum product exports in these countries.

From a regional equity market perspective, we would expect markets such as the US, Canada and EM EMEA to under-perform relative to Japan and the Euro area given the larger energy exposure by market cap in these equity markets.

Click to enlarge

Source: Commodity Themes In 2014, Deutsche Bank

Ten stocks from countries that benefit from lower oil prices are listed below for further research:

1.Company: Banco Santander-Chile (BSAC)

Current Dividend Yield: 3.60%

Sector: Banking

Country: Chile

2.Company: Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 2.06%

Sector: Electric Utilities

Country: Chile

3.Company:Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 4.12%

Sector: Telecom

Country: Philippines

4.Company: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.65%

Sector: Banking

Country: India

5.Company: ICICI Bank Ltd(IBN)

Current Dividend Yield: 1.40%

Sector: Banking

Country: India

6.Company: Israel Chemicals Ltd. (ISCHY)

Current Dividend Yield: 8.13%

Sector: Fertilizers

Country: Israel

7.Company: POSCO (PKX)

Current Dividend Yield: 2.12%

Sector: Steel & Iron

Country: South Korea

8.Company: Nedbank Group Limited (NDBKY)

Current Dividend Yield: 4.33%

Sector: Banking

Country: South Africa

9.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield: 4.34%

Sector: Banking

Country: South Africa

10.Company:Telekomunikasi Indonesia Tbk Perusahaan Perseroan (TLK)

Current Dividend Yield: 2.42%

Sector: Telecom

Country: Indonesia

Note: Dividend yields noted above are as of Oct 28, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions