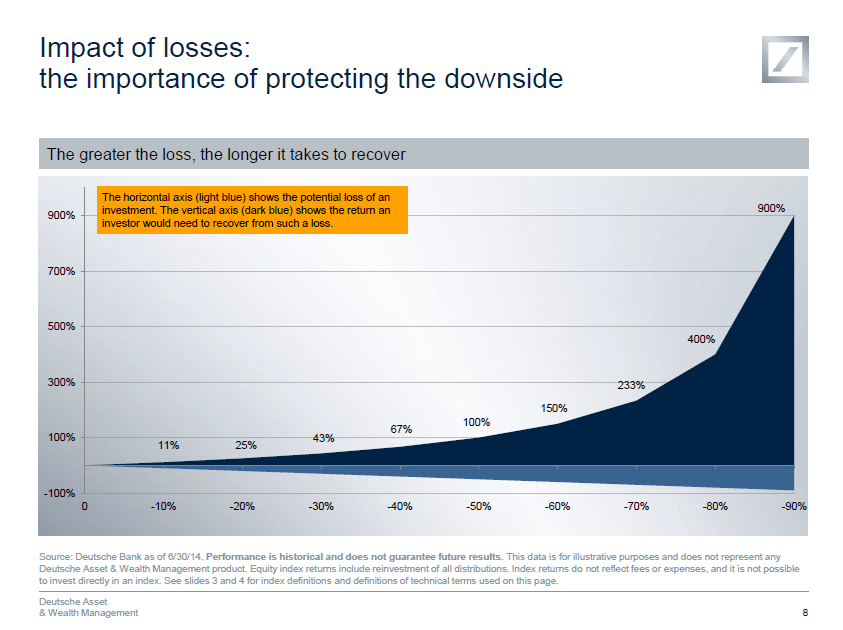

The S&P 500 has more than doubled from the low reached during the global financial crisis. However some investors’ portfolios may still not have recovered fully because some individual stocks they own may still be down from the highs reached before the crisis. Hence cutting down losses on an investment is important. Waiting for a stock that has fallen hard to recover may not be always be the wise strategy especially if the stock shows no signs of uptrend even after many years. So in such cases it is better to take the losses and move on. For example, lets consider a hypothetical $10 stock that falls 90% . In order for an investor to recoup their original investment, the stock has to rise to $1 to $10 (or) to put it in another way it has to rise by 900% which is huge. This stock may take many years to get back to even. So the greater the loss the longer it takes to recover. This simple concept is very important to understand for ordinary investors. The following chart shows this concept figuratively:

Click to enlarge

Source: Source: Managing risk factors to build a better portfolio, Deutsche Asset & Wealth Management