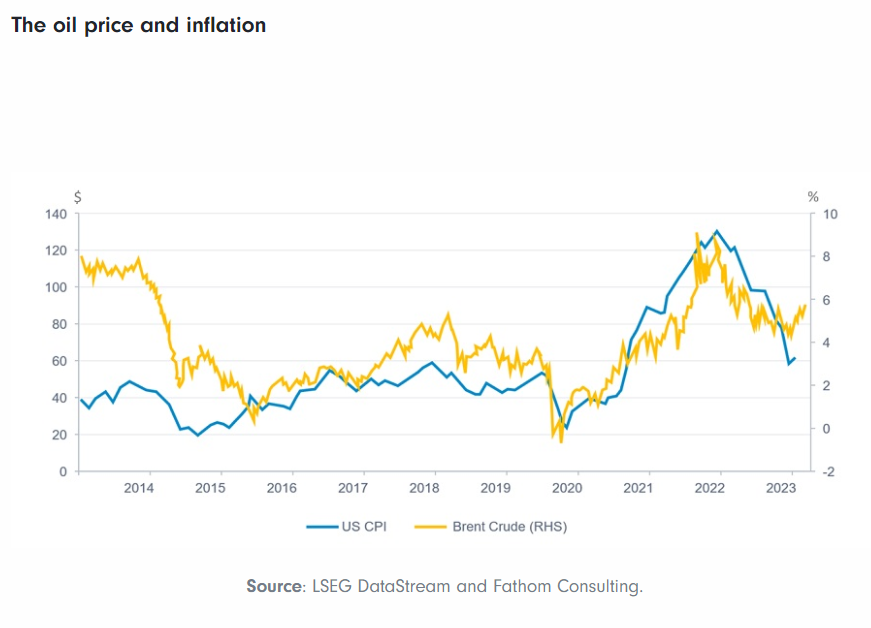

The oil and gas industry is the one of the most important industries in many countries. The economies of Middle Eastern countries are based oil and natural gas. It is also the largest sector of the Russian economy. As a commodity, crude oil prices are volatile and fluctuate based on an infinite number of reasons ranging from political to supply and demand. For example, a bunch of rag tag rebels in Nigeria setting fire to a pipeline can cause the global price of oil to shoot up. If wars, rebels and other factors do not inflate the price of oil then the OPEC cartel has the power to adjust the production and supply there by leading to higher prices.

In recent weeks crude oil prices have actually fallen. From over $100 a barrel oil prices (WTI) has plunged and closed last Friday at $91.13 on the NYMEX. As falling prices dings the revenues of the cartel members. OPEC has indicated that it would intervene if prices fall below $85 per barrel.If oil price falls below that set level, then OPEC will manipulate the production levels to prop up the price back to above $85.

From an investment standpoint, large-cap oil and gas companies offer many advantages such long-term growth, stable and decent dividend yields, higher earnings when oil prices rise, etc. Hence investors can consider allocating a portion of their portfolios to oil and gas stocks.

The following 14 global oil and gas giants appeared in the Global Top 100 Companies by Market Capitalization report published by PricewaterhouseCoopers earlier this year. Investors looking to gain exposure to this industry can consider adding these companies in a phased manner.

1.Company: Exxon Mobil Corp (XOM)

Current Dividend Yield: 2.88%

Country: USA

2.Company: Royal Dutch Shell PLC (RDS.A)

Current Dividend Yield: 4.22%

Country: UK

3.Company: PetroChina Co Ltd (PTR)

Current Dividend Yield: 3.46%

Country: China

4.Company: Chevron Corp (CVX)

Current Dividend Yield: 3.49%

Country: USA

5.Company: BP PLC (BP)

Current Dividend Yield: 5.09%

Country: UK

6.Company: Total SA (TOT)

Current Dividend Yield: 5.34%

Country: France

7.Company: Schlumberger NV (SLB)

Current Dividend Yield: 1.57%

Country: USA

8.Company: Sinopec Corp (SNP)

Current Dividend Yield: 3.50%

Country: China

9.Company: Gazprom OAO (OGZPY)

Current Dividend Yield: 5.43%

Country: Russia

10.Company: Petrobras SA (PBR)

Current Dividend Yield: 2.96%

Country: Brazil

11.Company: Eni SpA (E)

Current Dividend Yield: 4.71%

Country: Italy

12.Company: Statoil ASA (STO)

Current Dividend Yield: 4.22%

Country: Norway

13.Company: Ecopetrol SA (EC)

Current Dividend Yield: 6.92%

Country: Colombia

14.Company: ConocoPhillips (COP)

Current Dividend Yield: 3.72%

Country: USA

Note: Dividend yields noted above are as of Sept 12, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long PBR