The iShares MSCI Germany Index Fund(EWG) is down over 8% year-to-date while iShares MSCI France Index Fund (EWQ) is down just over 3%. The German ETF is down since German stocks has been more negatively impacted due to the Ukraine crisis. Germany has more exposure to Russia than France.

Here is a quick comparsion of the two ETFs:

a) iShares MSCI Germany Index Fund (EWG):

Net Assets = $4.8 Billion

Number of Holdings = 55

Distribution Yield = 4.24%

b) iShares MSCI France Index Fund (EWQ):

Net Assets = $2.6 Billion

Number of Holdings = 74

Distribution Yield = 4.40%

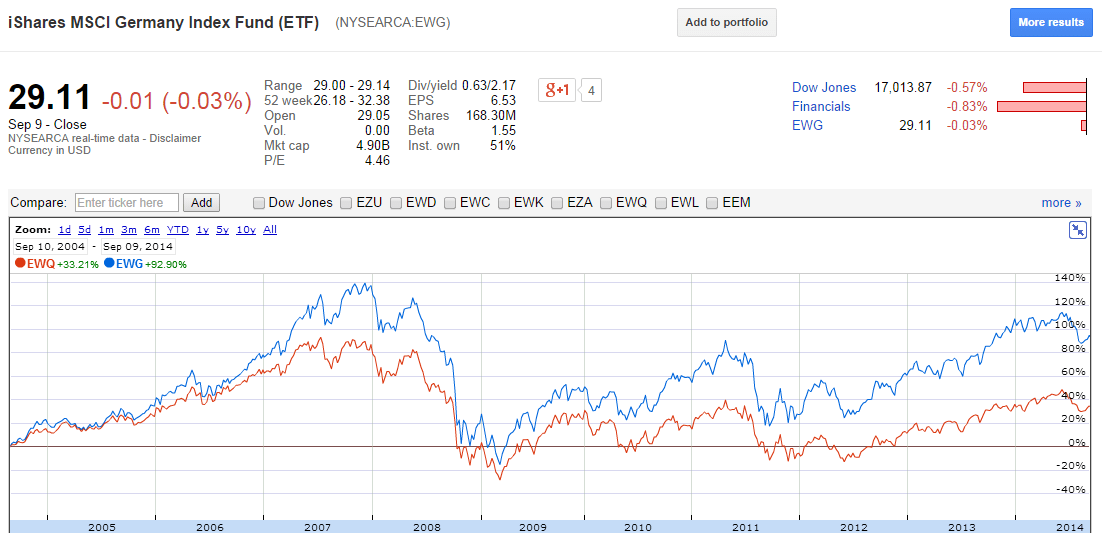

However over the long-term the German ETF handily beat the French ETF. For example, over 5 years the German ETF was up by over 40%. But the French ETF was up by only 14%. Similarly over the 10 year period, Germany shot up by 82% while France went up just 33%. So long-term investors may want to ignore short-term performance of German equities.

The 10-year performance of the two ETFs are shown below:

Click to enlarge

Source: Google Finance

Disclosure:No Positions