The yield on the 10-year Treasury note rose about 0.08% to close at 2.16% on Friday.The 30-year U.S. Treasury bond rose 0.07% and closed at 3.32%. The yield on the 10-year Treasury bond rose dramatically by 27% in last month alone. Bond yields and prices are inversely related to each other. Hence as yields rise bond prices fall.

Currently investors expect the Federal Reserve to wind down its bond-buying program later this year and interest rates to rise. A rise in interest rates would lead to a fall in bond prices. So investors may be tempted to dump bonds now and hold only other assets such as stocks, cash, gold, etc.According to a research report published by The Schwab Center for Financial Research (SCFR), bonds still play a role in an overall portfolio for the following reasons: Diversification and reduced volatility, Income, Time, Capital Preservation and A Stable Foundation.

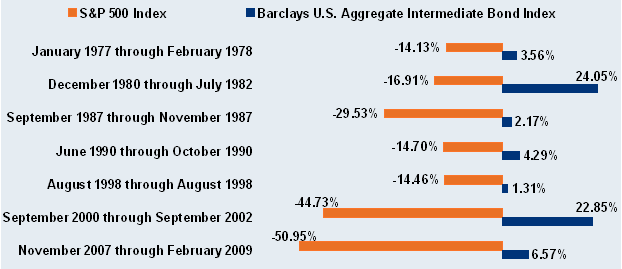

To support the argument for holding bonds in a portfolio, the authors of the report Kathy A. Jones, Rob Williams and Collin Martin included in the following neat chart comparing the performance of stocks and bonds when stocks declined 14% or more since the 1970s:

Click to enlarge

Source: Schwab Bond Insights: Timing the Taper, Charles Schwab

The above chart shows that when stocks declined heavily bonds yielded a small positive or even a substantially higher return. Hence holding bonds can provide a cushion effect to a portfolio of stocks. In addition, bonds tend to reduce a portfolio’s volatility as equities are generally more volatile.

During the recent global financial crisis (from November 2007 thru February 2009), when stocks plunged by over 50% as measured by the S&P 500, bonds yielded a decent return of 6.57%. When the dot com bubble popped in early 2000, stocks fell by about 45% but bonds had an excellent return of about 23.0%.The positive impact of holding bonds during such periods cannot be understated.

It is a wise idea to hold bonds as of part of a well-diversified portfolio. However the question of how much fixed income securities should one hold depends on many factors including age, tax bracket, goal, investment horizon, etc. of an investor.

Five bond ETFs with their current yields are listed below for consideration:

1. iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

Distribution Yield = 3.61%

2. iShares TIPS Bond ETF (TIP)

Distribution Yield = 2.97%

3. Vanguard Total Bond Market ETF (BND)

SEC Yield = 1.65%

4. iShares Core Total U.S. Bond Market ETF (HYG)

Distribution Yield = 2.11%

5. SPDR® Barclays High Yield Bond ETF (JNK)

30-Day SEC Yield = 4.97%

Disclosure: No Positions