The US equity market as represented by the S&P 500 has shot up by 21% YTD. While double-digit growth is excellent, the market has become overvalued especially when compared to other developed markets. So for a value-oriented investor better opportunities exist elsewhere.

The S&P 500’s forward P/E is 21.0. This is much higher than the historical average of about 17.0.

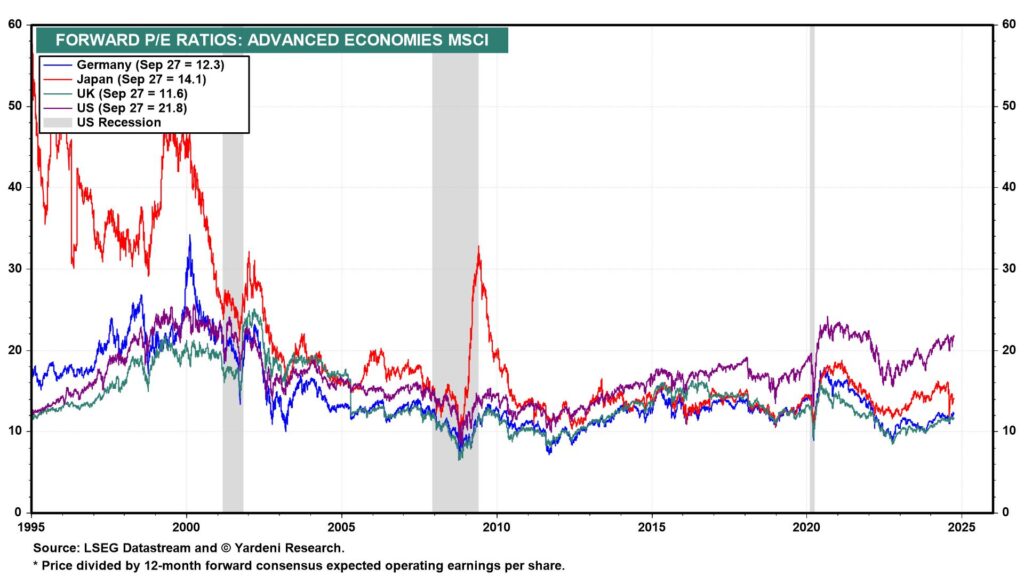

Based on the MSCI Index values, the forward P/E for the US is 21.8 as shown in the chart below. This is much higher than the other developed markets such as Germany at 12.3. Though US markets always command a premium relative to other markets, the divergence has grown wider.

Click to enlarge

Source: Yardeni Research

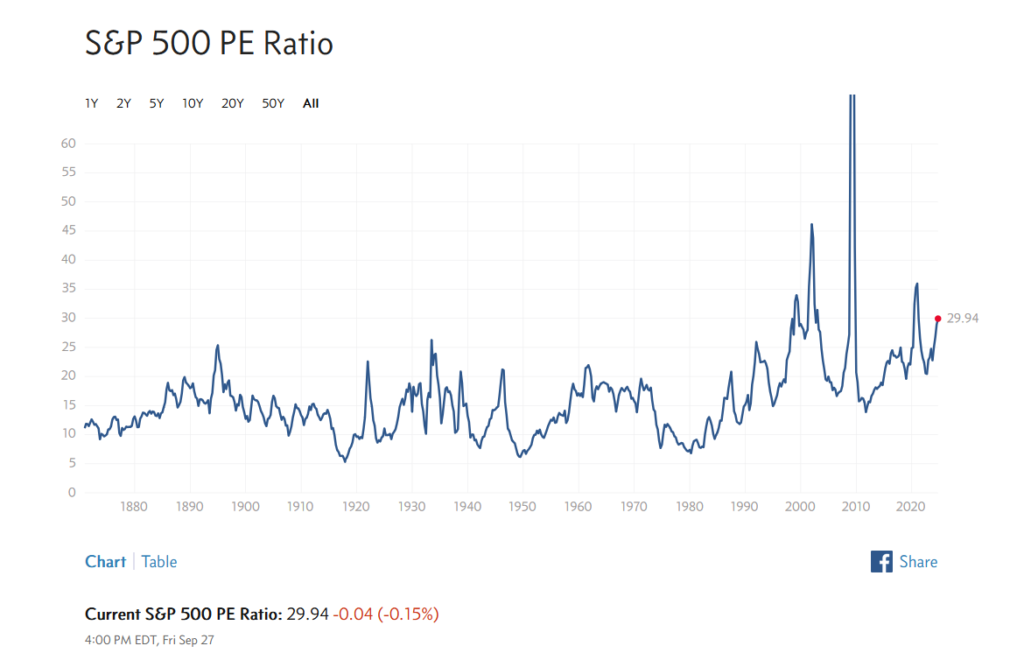

The S&P 500 P/E ratio based on trailing 12-month earnings is nearly 30 according to the latest data from multipl.com.

Source: Multipl

For US investors it may be wise to be cautious at current levels. Certain parts of the market such as technology including the AI-fueled chip sector are overvalued to say the least.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF(VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No positions