The Canadian equity market is one of the largest markets in the world. According to TSX, the total market capitalization of companies listed in the TSX and TSX Venture Exchanges was $5.0 Trillion as of 2024. A total of 3,417 companies were publicly traded on these exchanges. For Canadian investors it may seem like the home market is more than enough to find attractive opportunities. However that is not the case. I have written about why Canadian investors must diversify globally earlier. This is a followup quick post on the topic.

Three reasons why investors in Canada must invest overseas are:

- The Canadian equity market represents less than 3% of the world’s market capitalization based on MSCI World Index at the end of 2024.

- Of the Top 500 companies the world, only 14 are in Canada.

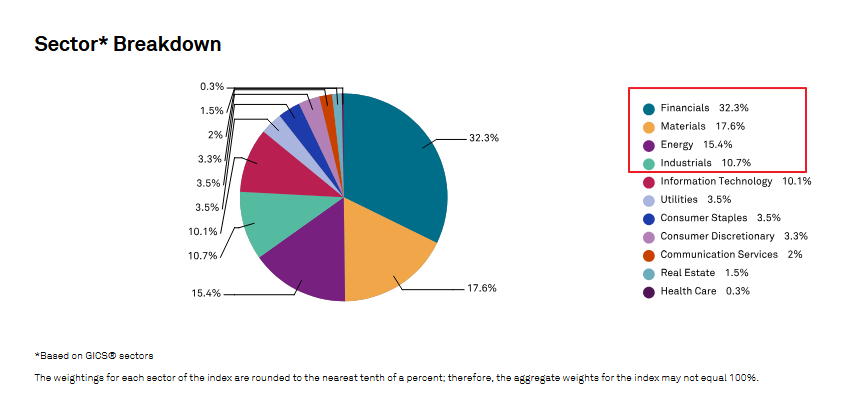

- About 75% of the market is concentrated in just 4 sectors – Financial Services, Energy, Industrials and Materials. Globally these sectors account for only about 35%.

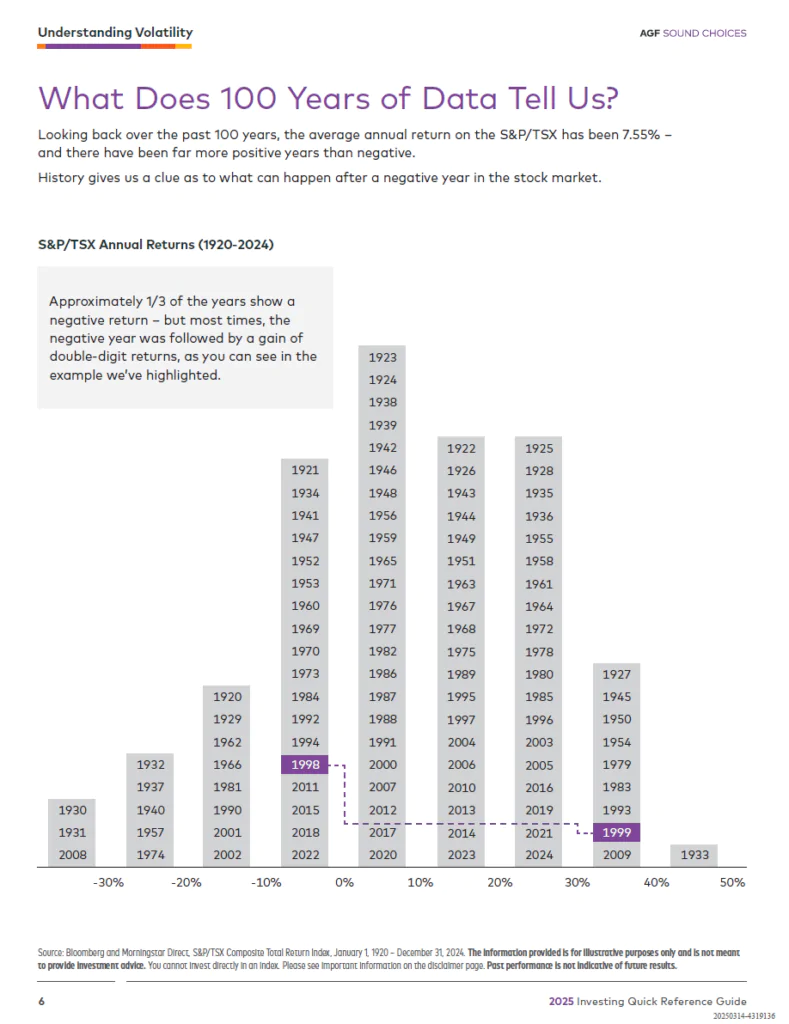

Source: 2025 Investing Quick Reference Guide, AGF

The S&P/TSX composite index has had a return of over 29.41% on price return basis (C$) as of Dec 26, 2025. The following chart shows the concentration of the four sectors in the index as of Nov end, 2025:

Click to enlarge

Source: S&P

From a return perspective, it is possible to earn higher returns investing abroad. For example, Canadian stocks returned 21.65% in 2024 while US equities returned 36.36% in Canadian dollar terms. There were many other countries that generated even better returns.