The defense sector has been one of the big growth sectors for many years now and continues to grow further. The ongoing Russia-Ukraine war, middle-east conflicts and other geo-political risks around the world keep defense companies busy. I came across an article by Arian Neiron at VanEck in which he discussed the benefits of investing in defense stocks.

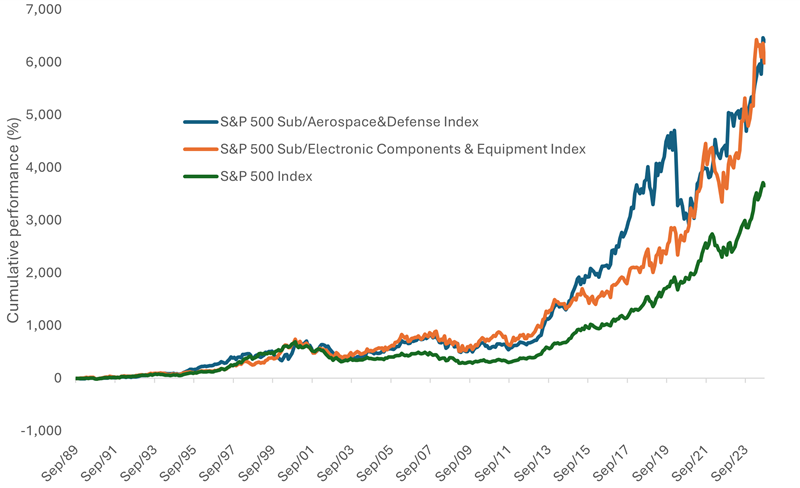

In the long-term, defense stocks have outperformed the broader market as shown in the chart below:

Click to enlarge

Source: A megatrend hiding in plain sight: defence by Arian Neiron, VanEck

He identified the following three reasons for owning stocks from the industry as part of a well-diversified portfolio:

- Spending by governments toward the sector is increasing.

- Demand for the sector’s products and services has not historically correlated to the economic cycle.

- The defence industry has historically been at the forefront of technological development and advancement.

Defense stocks are having another great run so far this year.For instance, American defense giant Lockheed Martin Corporation (LMT) has soared by 27% YTD.

The following are some of the top defense stocks that investors can consider for further research:

- General Dynamics (GD)

- Northrop Grumman (NOC)

- L3Harris Technologies, Inc. (LHX)

- RTX Corporation (RTX)

- BAE Systems PLC (BAESY)

- Ingersoll Rand Inc (IR)

Disclosure: No positions