Cigarette Taxes in Europe are high and vary widely across countries. In fact, smokers pay more in taxes than on the cigarettes themselves. The EU requires member states to charge a minimum excise tax which is a fixed amount per pack of on cigarettes and other tobacco products. In addition EU countries add an additional percentage of the sales price which raises the prices more.

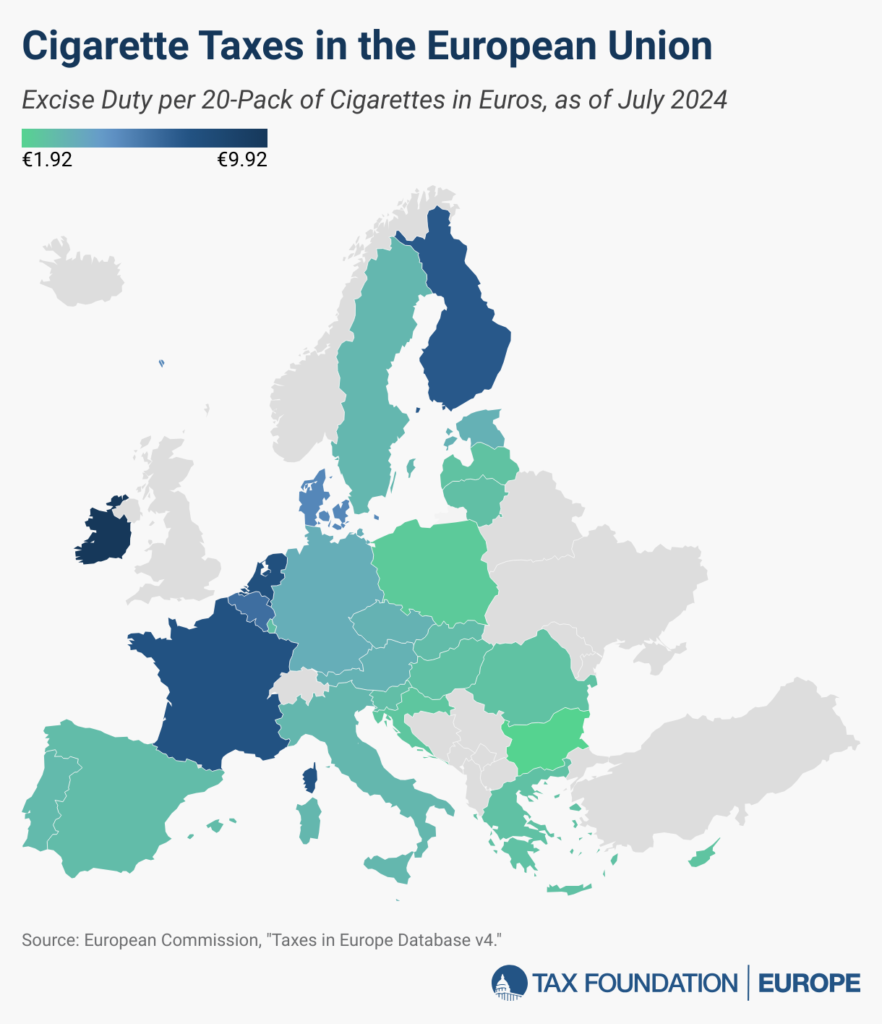

The highest taxes are in the developed EU countries while the lowest are in the East European countries of the EU. The following chart from the Tax Foundation shows the variance of cigarette taxes in Europe:

Click to enlarge

Source: Tax Foundation

For the full data of tax rates on all the countries click on the above link.