The US equity market has been up strongly almost every year for the past few years. While gains are nice it is also important to remember that stocks do not always generate positive returns. To put it another way, losses are a feature of investing in the markets and investors have to deal with them in a wise manner.

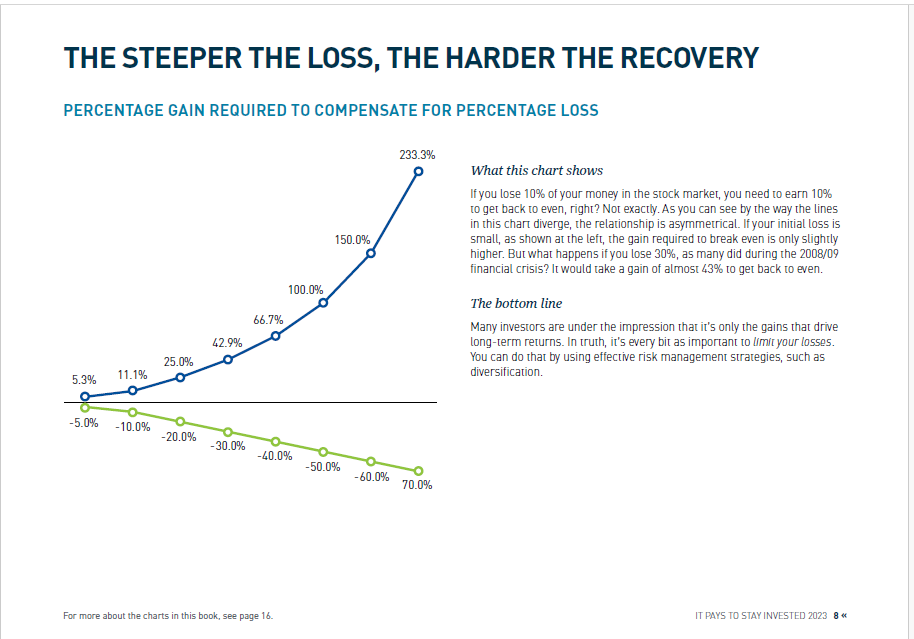

When a stock in an investor’s portfolio is at a huge loss it is not easy to recover the losses easily. If the percentage of loss is higher the percentage of gains required to break even is even higher. For example, if a stock goes from $10 to $5 that is 50% loss. However an investor has to earn more than 50% to get to the break even price of $10. It is not enough for the stock to recover by exactly 50% to reach the break even price of $10. A 50% rise would put the price at just $7.50 ($5 + $2.50 (50% of $5). So to get to $10, the stock has to double or rise by 100%. This is where it gets tough to say the least. So the key point to remember is as the percentage of loss increases the percentage of gain required to get even increases exponentially.

The following neat chart shows this critical concept figuratively:

Click to enlarge

Source: It pays to stay invested, Northwest & Ethical Investments L.P.