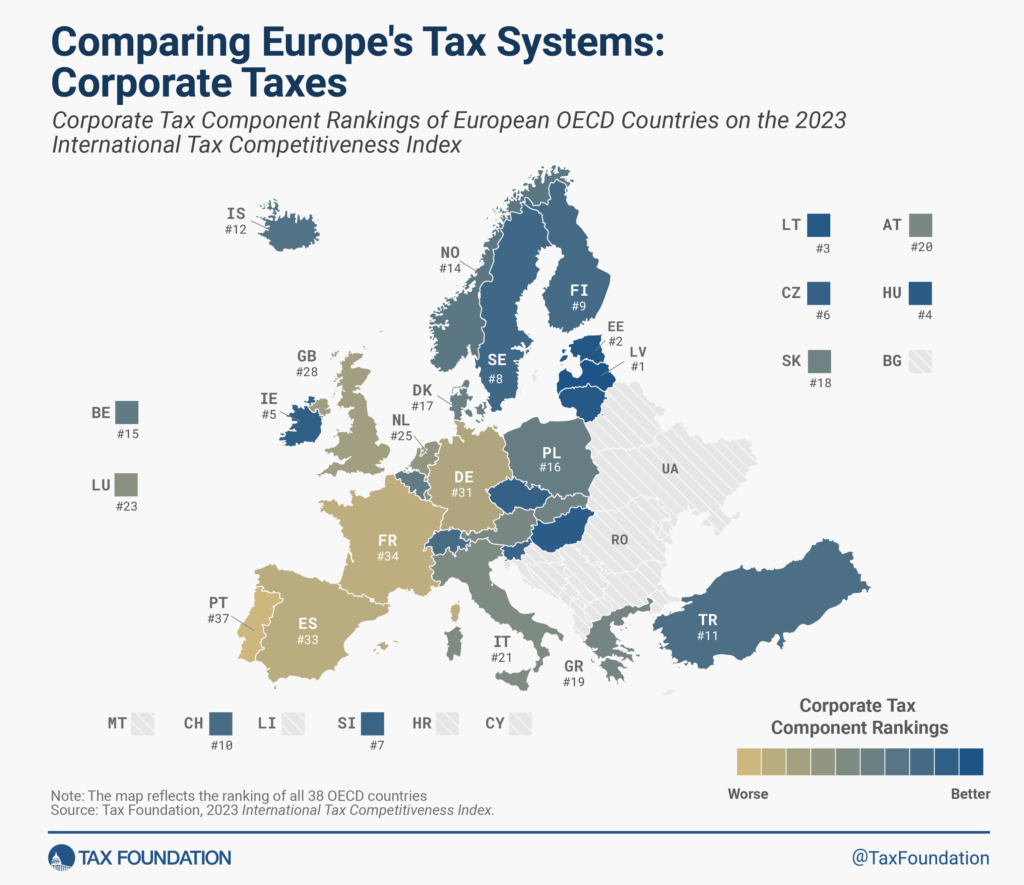

Corporate tax rates vary across the countries in Europe. Some countries have friendly corporate tax regimes while others do not. According to the Tax Foundation, Portugal has the worst corporate taxes while Latvia and Estonia have the best rates.

Click to enlarge

Source: Comparing Europe’s Tax Systems: Corporate Taxes, Tax Foundation

A short excerpt from the above piece:

Latvia and Estonia have the best corporate tax systems in the OECD. Both countries have a cash-flow tax on business profits. This means that profits only get taxed when they are distributed to shareholders. If a business decides to retain or reinvest its profits instead of paying dividends to shareholders, there is no tax on such profits.

In contrast, Portugal has the least competitive and neutral corporate income tax system in Europe (Colombia ranks the lowest in the OECD). At 31.5 percent, Portugal levies one of the highest combined corporate tax rates on business profits, including multiple surtaxes. Only limited net operating losses can be carried forward and carried back; purchases of machinery, buildings, and intangibles cannot be fully expensed.