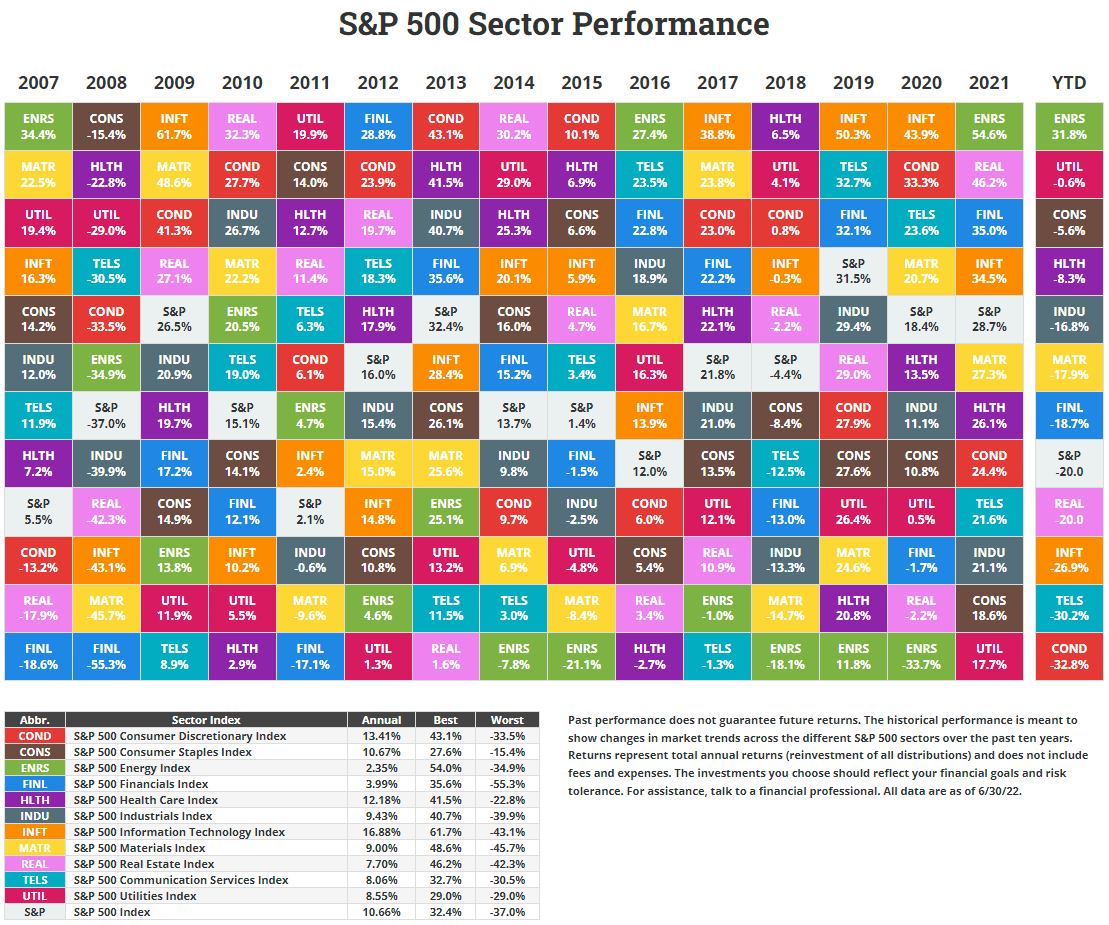

Novel Investor has updated the sector returns chart for the S&P 500 for the first half of year 2022. This chart shows the annual returns of the various sectors of the S&P 500 together with the current year data.

With bear market raging across the equity market, the best performing sector this year has been the energy sector with a return of over 31%. This follows the best performance of the sector in 2021. The other sectors that have relatively performed better so far this year include: utilities, consumer staples and health care.

On the other hand, the worst performing sector is consumer discretionary followed by communication services and information technology. All these have declined much more than the S&P 500 as shown in the chart below:

Click to enlarge

Source: Novel Investor

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No positions