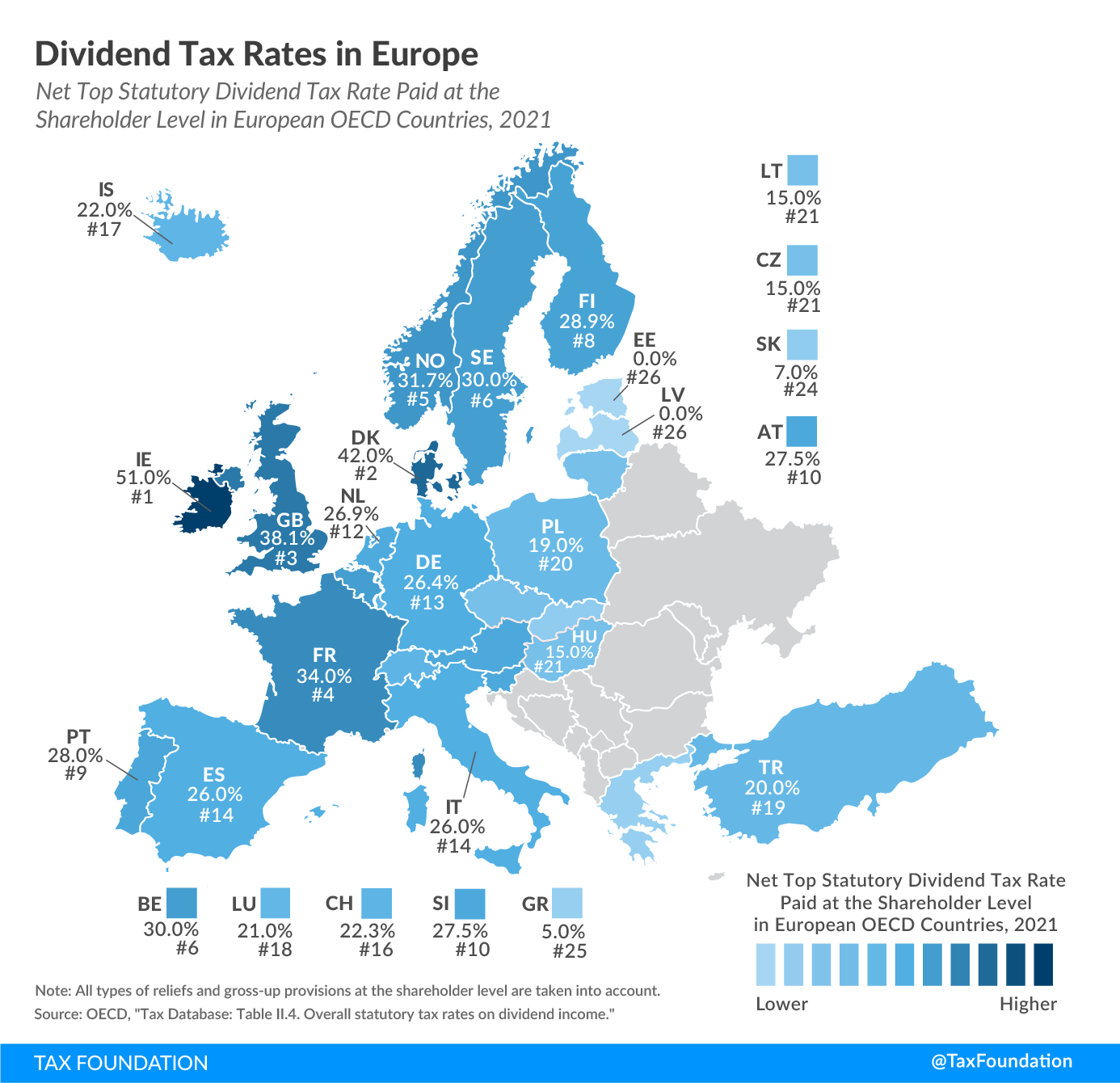

Taxes on dividends paid out to shareholders of a corporation is an important source of revenue for countries. Similar to taxes on personal income, capital gains, etc. the tax rate on dividend varies between countries. The following chart shows “the top personal dividend tax rate, taking account of all imputations, credits, or offsets” for European OECD countries in 2021:

Click to enlarge

Source: Dividend Tax Rates in Europe, Tax Foundation

Latvia and Estonia do not have a tax on dividends. Instead they levy a 20 percent corporate tax on profits that are distributed to shareholders.

Ireland has the highest dividend tax rate at 51 percent followed by Denmark and the UK at 42 and 38.1 percent respectively.