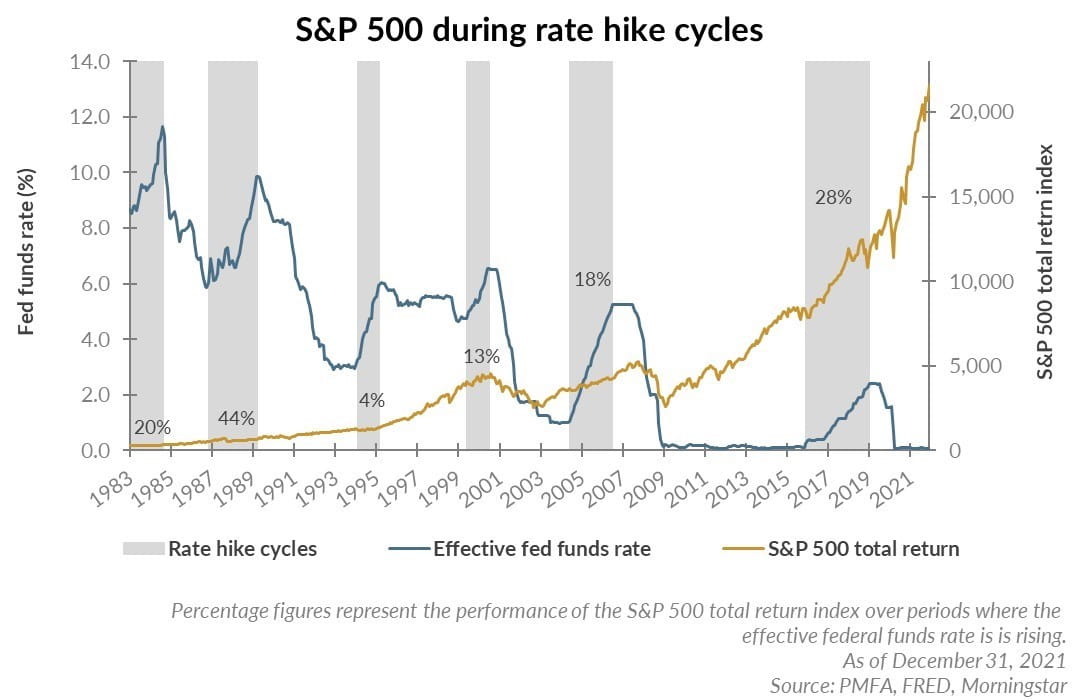

The Fed has planned to raise interest rates this year. The forecast is rates will increase at least three times in the year. In anticipation of rising rates and a multitude of other factors including valuation concerns in certain sectors, US equity markets have turned very volatile this year. With interest rates bound to go higher many investors are wondering how stocks would perform this year. According to an article at Plante Moran, stocks have typically earned positive returns when interest rate rises though there were short-term volatility as shown in the chart below:

Click to enlarge

Source: How do stocks typically perform when the Fed raises interest rates?, Plante Moran

Update: 1/26/22:

Related ETFs:

- SPDR S&P 500 ETF (SPY)

Disclosure: No positions