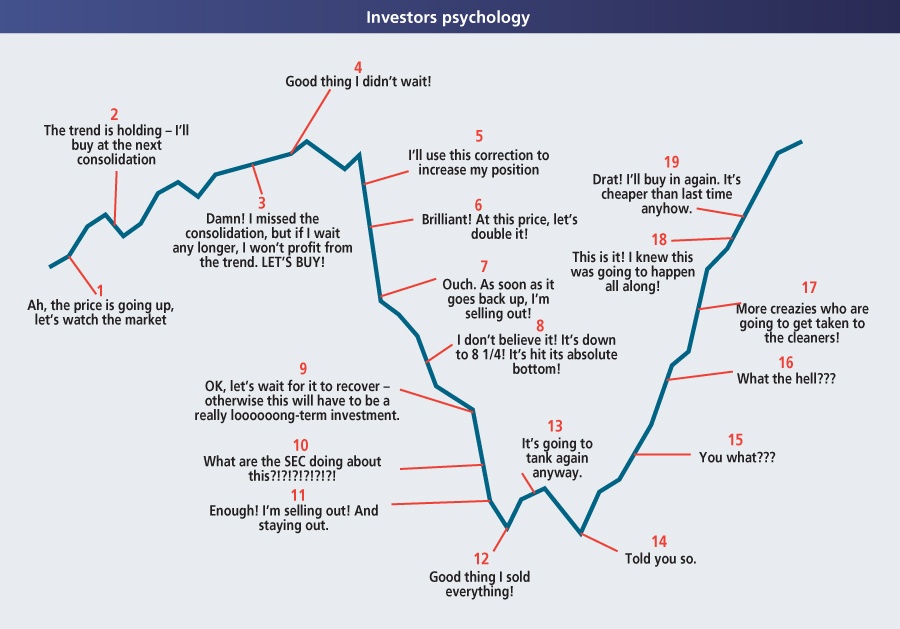

One of the main factors that differentiates successful investors from average or unsuccessful investors is psychology. This is especially true with retail investors. Many retail investors are prone to timing the market. Instead of having a long-term view and being patient they try to get in and get out of the market at perfect times. This is of course impossible to execute in real life since markets are unpredictable. However human psychology is such that we are overconfident and assume we can beat the market despite mountains of evidence to the contrary. The following is a caricature of a typical retail investor’s psychology:

Click to enlarge

Source: A caricature of retail investors psychology, Investment Office