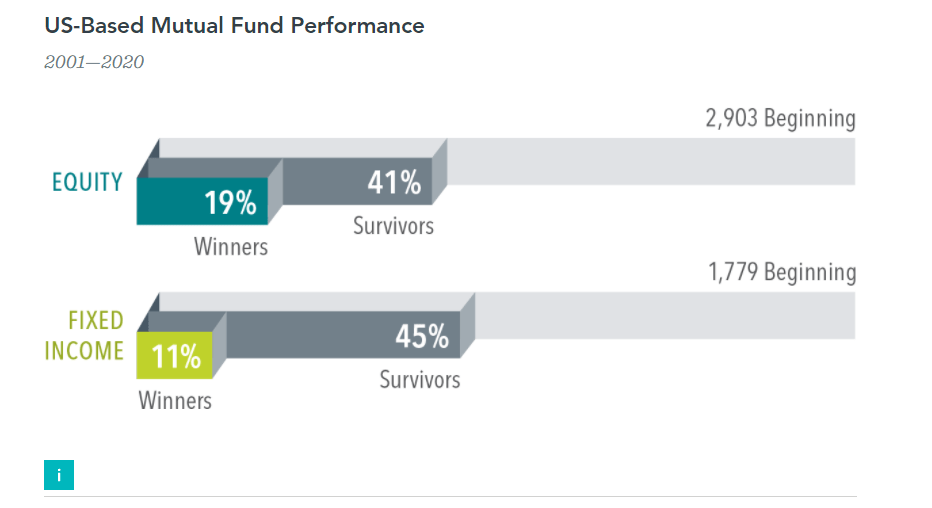

Some investors prefer to invest via mutual funds than individual stocks or ETFs. As with any asset type, though mutual funds have their advantages there also disadvantages. The first is most funds that exist at the time of investment won’t exist after 20 years. This makes them less than attractive for long-term investment. According to an article at Dimensional Fund Advisors, in the period from 2001 to 2020 only 41% of the funds were survivors – meaning of the 2903 funds that were existing in 2001 only 41% (or 1,190) existed at the end of 2020.The remaining funds were closed for any number of reasons. So for a long-term investor the probability of picking a fund that will exist in 20 years is pretty slim.

Click to enlarge

Source: Key Questions for Long-Term Investors, Dimensional Fund Advisors

Another cons of mutual funds is performance. Very few of them ever beat the market or their benchmarks. Based on the above article, only 19% of the funds outperformed their benchmarks during the 20 years. Or to put it another way less than one-fifth of the funds were outperformers.

For Fixed Income funds, the survivorship rate was a little better at 45% but the winners were even less at 11% of the total funds during the 20-year period.

Even the above performance figures can be misleading since it depends on the benchmarks. Not all funds use proper benchmarks and a inappropriate one can skew a funds’ performance levels.