Dividends are important factor to consider to boost return with equity investments. I have written many times before in this blog that dividends provide a cushion to a well-diversified portfolio during adverse market conditions and help increase the total return of an investment. To put it another way, buying dividend-paying stocks and then reinvesting the dividends will lead to higher total return especially in the long run in most cases. In rare situations one can lose both the principal and the reinvested dividends if a company goes bankrupt. During the Global Financial Crisis of 2008-09 many investors lost big following this strategy when banks failed and equity became worthless. However things like the GFC are not frequent enough to avoid this concept entirely.

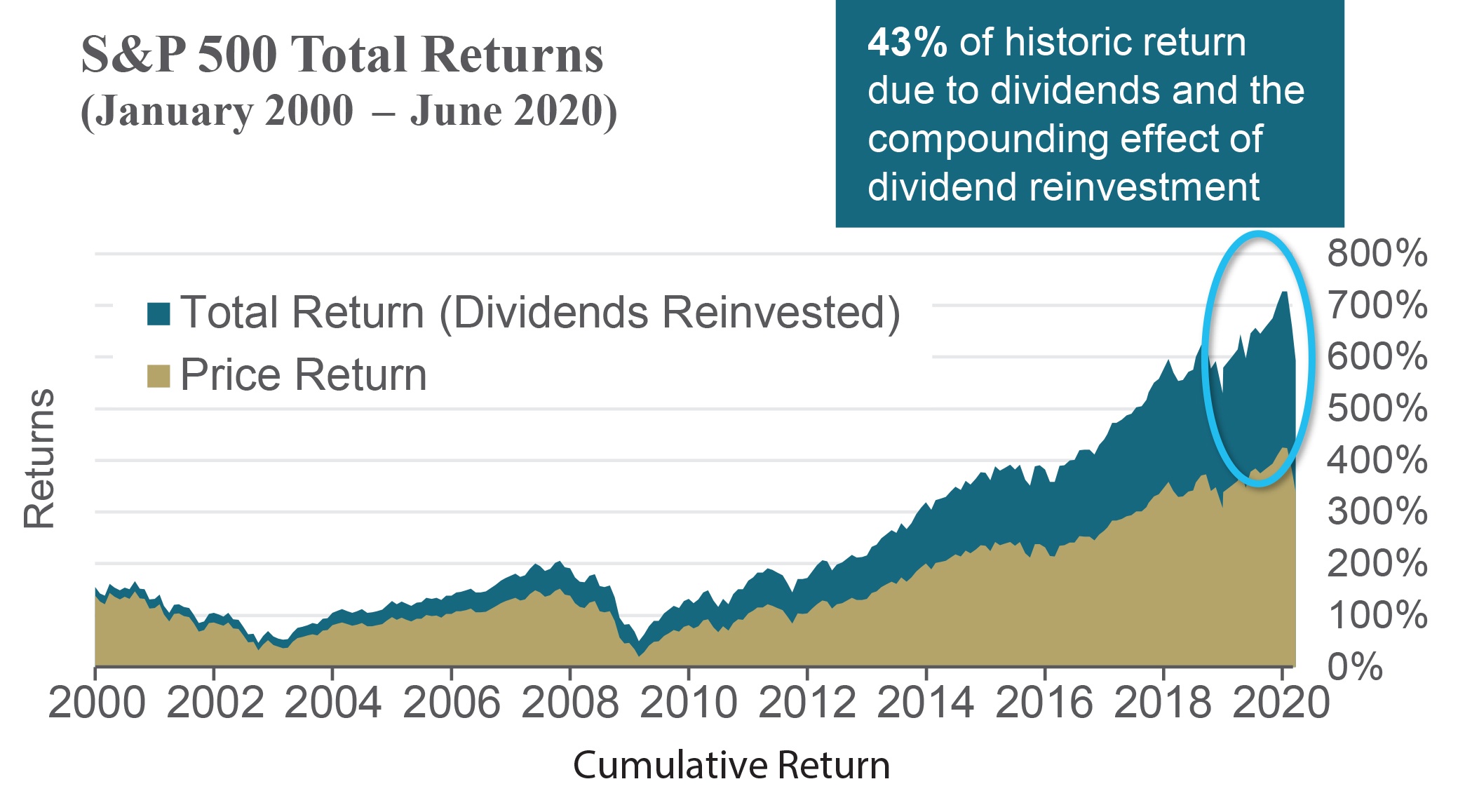

From January, 2000 to June, 2020 S&P 500 has soared by 700% based on total returns (dividend reinvested). This is 43% higher than price returns only. The power of compounding over many years led to a solid 43% excess return.

Sources: FactSet, Mellon Investments Corporation June 30, 2020. Past performance is no guarantee of future results. Charts provided are for illustrative purposes only and not indicative of the past of future performance of any BNY Mellon product.

Source: Equity income investing: A strategy for unpredictable markets, BNY Mellon

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions