Inflation has become one of the main topics in the US media in recent weeks. Prices of autos to food and restaurant meals are going up to the surprise of the general population which generally was protected from the ravages of inflation for many years now. Curious investors are wondering about the impact of inflation on equity returns. While it is well known that stocks traditionally yield a return that beats inflation, it is still important how stock returns are affected during different phases of inflation.

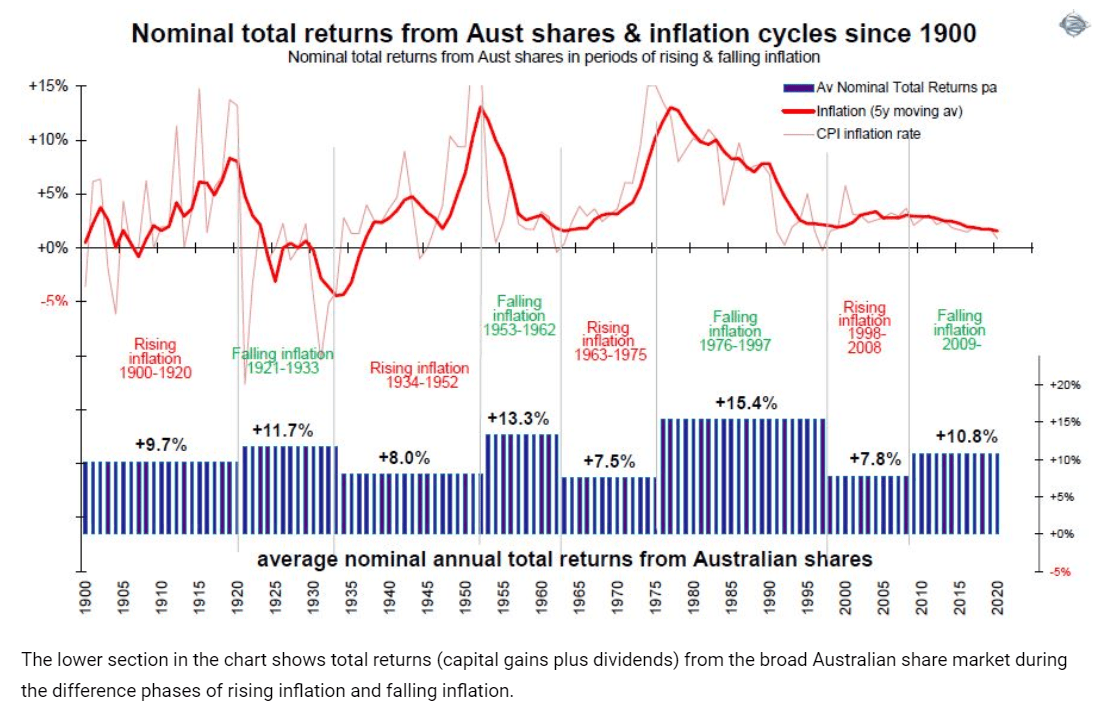

I recently came across an excellent piece at Firstlinks that discussed the very topic from an Australian perspective. The gist of the article is during rising inflation periods, equity returns decline. But during periods of falling inflation, equity return increases as shown in the chart below:

Click to enlarge

Source: How inflation impacts different types of investments, Ashley Owen, Firstlinks, Australia

It should be noted that the returns shown above are not adjusted for inflation. So the total return of 7.8% during the rising inflation period of 1998 to 2008 is lesser when accounted for inflation. The “real” return during that period was just 4.3%.

The key takeaway is investors can expect to earn lower returns from equities during periods of rising inflation and vice versa. As the US is in the rising phase of inflation cycle currently equity returns would be lower not higher in the future.

Related ETFs:

Disclosure: No positions