Investing in foreign stocks involves a thorough analysis of many factors such as market type (emerging vs. developed vs. frontier markets), form of government, liquidity, transparency, accounting standards, etc. After deciding on a particular country, it is again important to determine in what industries or sectors to invest in. This decision is critical because each countries excels in one or more industries. To put it another way, one country’s strength may be in industrial production while another may be a leader in commodities. So for example, if an investor decides to invest in a natural resources-rich country such as Brazil or Australia it is wise to pick stocks in the commodity industry. It would not make sense to look for EV industry or semiconductor plays in these countries. Instead going with an agricultural producer in Brazil or an iron-ore miner in Australia is a sound strategy.

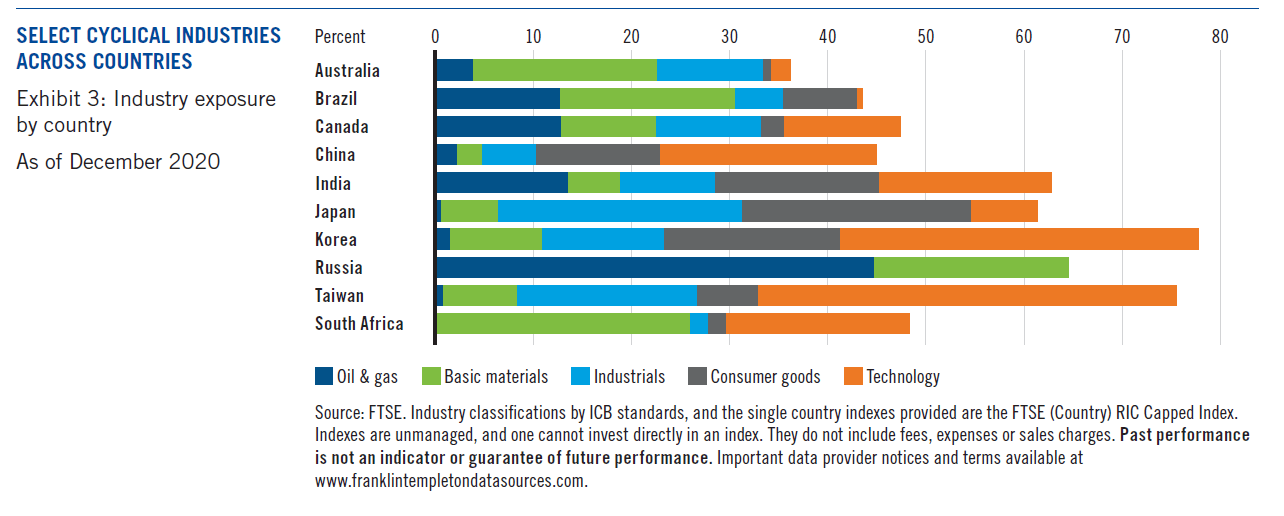

With that said, the below chart shows the industry exposure by country. As commodity prices have surged this year, countries with high exposure in this sector would benefit from further increases as the global economic recovery gains momentum this year.

Click to enlarge

Source: Single-Country Allocation: Viewing the Opportunity Through Three Lenses, Franklin Templeton

Russia is a top oil & gas producer while Taiwan and South Korea are heavy weights in the technology sector. So investment picks in these countries should mirror this logic. Searching for tech leaders in Russia is not the best idea. On the other hand picking up stocks in Russian oil & gas producers has better potential for high returns.

Listed below are a few stocks from some of the above countries:

- Russia – Gazprom(OGZPY), LUKOIL (LUKOY), Rosneft Oil Company (OJSCY) and Surgutneftegas (SGTPY)

- Brazil – Petrobras SA (PBR) and Ultrapar Participacoes SA (UGP)

- Taiwan – Taiwan Semiconductor Manufacturing Co Ltd (TSM), United Microelectronics (UMC) and AU Optronics (AUO)

- Australia – BHP Billiton (BHP) and Piedmont Lithium (PLL)

- South Africa – AngloGold Ashanti (AU) and Harmony Gold (HMY)

Disclosure: Long PBR