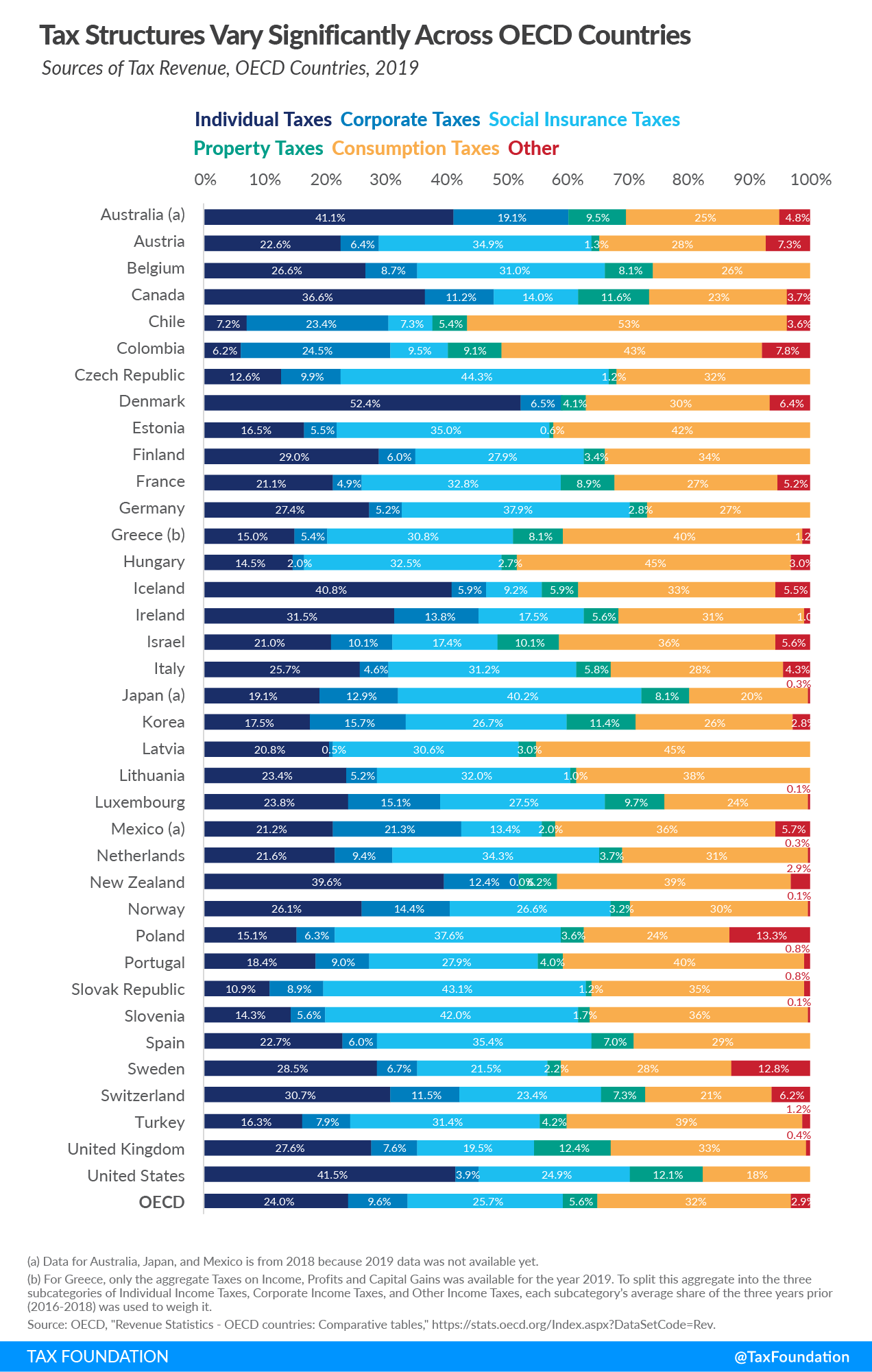

Governments in the OECD countries collect tax revenues that can be grouped into the following categories: Consumption Taxes, Social Insurance Taxes, Individual Taxes, Corporate Taxes, Property Taxes and Other. On an average, Consumption Taxes such as Value-Added Tax (VAT) accounted for one-third of tax revenues in OECD member countries in 2019 according to an article by Cristina Enache at The Tax Foundation.

The second and third most revenues came from Social Insurance Taxes and Individual Income Taxes. In terms of Corporate Taxes, on average just 9.6% of revenues were accounted from Corporate Taxes collected.

In the US, corporations are considered as human beings by law. They are living, breathing human beings that can do almost everything a human does like marry another corporation, fight for rights, lobby for favorable rules and regulations, contribute to political campaigns, etc. However when it comes to paying real humans pay the most taxes in the country as opposed to corporations, which are also humans in a technical sense. Americans contributed 41.5% of federal government revenue in the form of individual taxes. Corporations on the other hand paid 3.9% of the revenue. Or to put it another way, individuals paid more than ten times in taxes than corporations. The OECD average corporate tax rate is 9.6%. Some of the countries that earned high revenues from corporate taxes were: Australia, Chile, Colombia and Mexico.

The following chart shows the various sources of revenue for OECD countries:

Click to enlarge

Source: Sources of Government Revenue in the OECD by Cristina Enache, The Tax Foundation