Innovation plays an important role in the success of a business. Companies that invest heavily in R&D and come up with market-leading technologies or products tend to be rewarded by consumers and investors. With new technologies such as Electric Vehicles, Battery technology, Artificial Intelligence, Robotics, Cloud Computing, Renewable Energy, etc. emerging faster and getting more media and investors’ attention it is important to understand how new technologies – especially disruptive ones – are adopted by the general public.

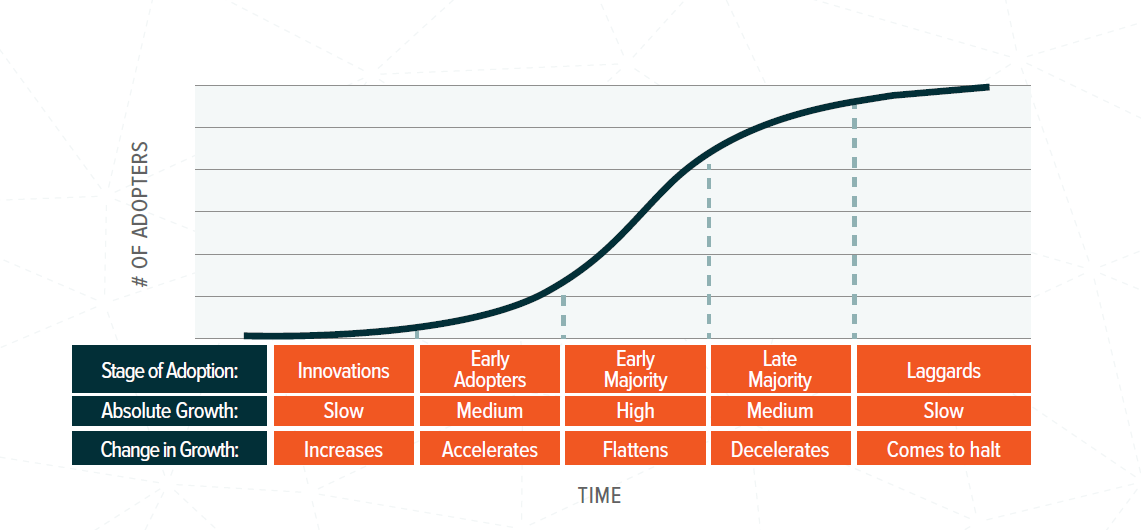

The Diffusion of Innovation Theory developed by E.M. Rogers in 1962 explains how innovative ideas and products are diffused (spread) over time through the general population. According to this theory, there are five established adopter categories:

- Innovators

- Early Adopters

- Early Majority

- Later Majority

- Laggards

Source: Diffusion of Innovation Theory, Boston University School of Public Health

These five stages tend to follow an “S” shaped adoption curve as shown below from a report at Global X:

Click to enlarge

Electric Vehicles such as Tesla(TSLA) cars are in the Early Adopters stage now. The challenge for Tesla and other EV makers to dislodge the established dinosaurs like GM (GM), Ford (F), Toyota (TM), etc. and enter the majority stages. Of course, it is not the market cap that matters but wide adoption of the EV automobiles. Understanding in which stage an innovation stands can help investors determine the potential future trajectory of the product or company.

The same logic can be applied to other innovations. For example, ideas like space tourism in which millions of tourists can visit moon and beyond or delivery of things like a burger by a drone directly to our homes or flying taxis are just hype and will die out eventually.

But other innovations like renewable energy generation using wind, sun, waves, etc. , cloud computing, use of AI, etc. are in early stages of adoption.

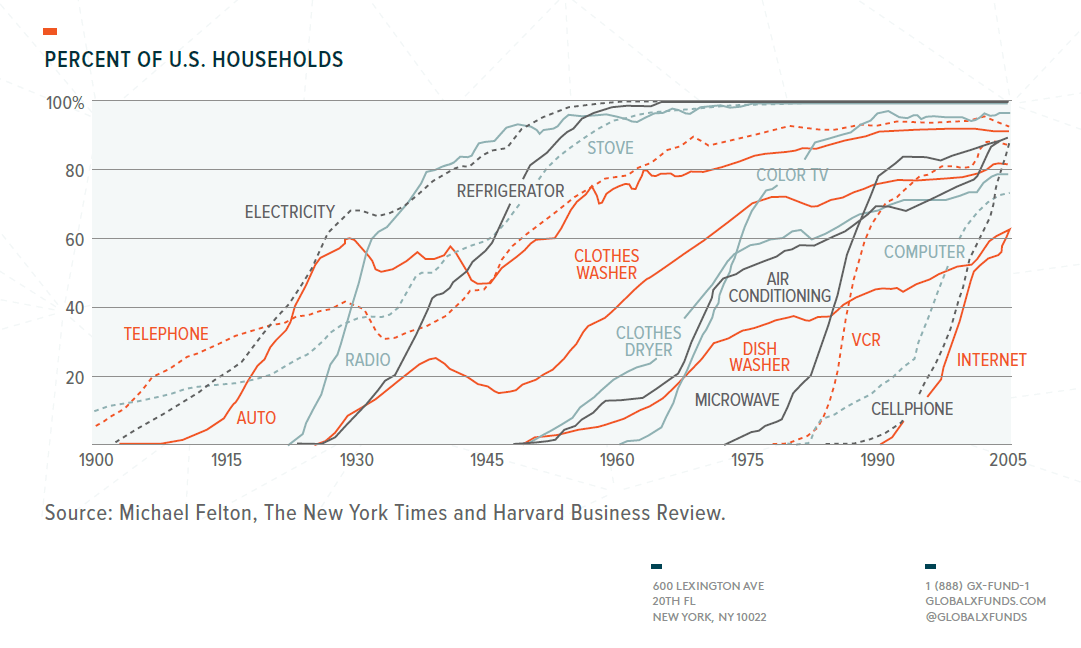

With that said, past innovations can provide us some evidence. Historical data shows while most of the innovations follow the “S” curve not all of them did:

Click to enlarge

Source: INVESTING IN TOMORROW – A WHITEPAPER ON THEMATIC INVESTING by Jay Jacobs, CFA, Director of Research, Global X Funds

Disclosure: No Positions