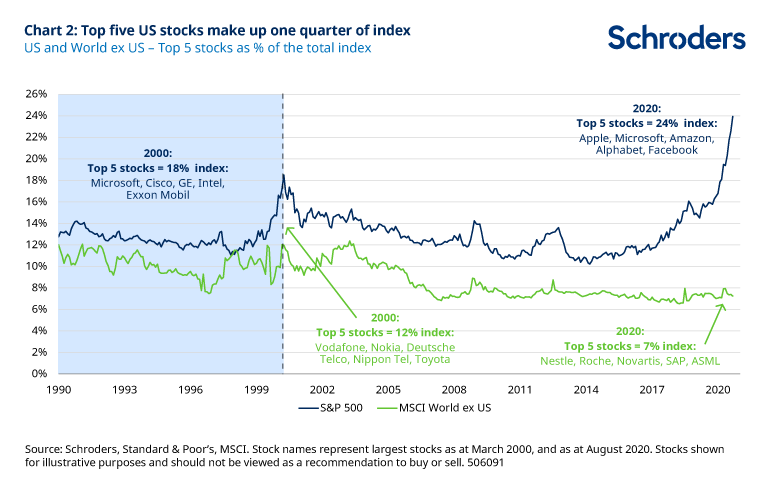

In a recent post I mentioned that US stocks beat foreign stocks hands down over the long term. However that does mean one should simply avoid foreign stocks. In addition to diversification benefits, currently international equity markets are less concentrated than US markets and also they offer plenty of choices relative to the US market. The following chart shows how concentrated the US equity market is compared to international markets:

Click to enlarge

Source: Six charts that make the case for international equities and value, Schroders

An excerpt from the above article:

Picking up point 5, the narrow breadth of the US market has been a feature of the past few years. This has been mainly due to the phenomenal success of the US tech giants.

The chart below shows how the top five US stocks alone now make up almost one quarter of the S&P 500 index. By contrast, the top five international stocks account for just 7% of the international benchmark (MSCI World ex US).

This reflects a period of extraordinary growth for those tech giants. Aside from Microsoft, most of them were barely a twinkle in their founders’ eyes at the turn of the 21st century. There’s no denying that, so far, there has been no good time to bet against their success continuing. But this does raise the question how much further this trend can go on.

As we’ve already said, it’s impossible to predict an optimal time to diversify portfolios. However, this level of concentration in US markets suggests to us that now is probably not the worst time to do so at least.

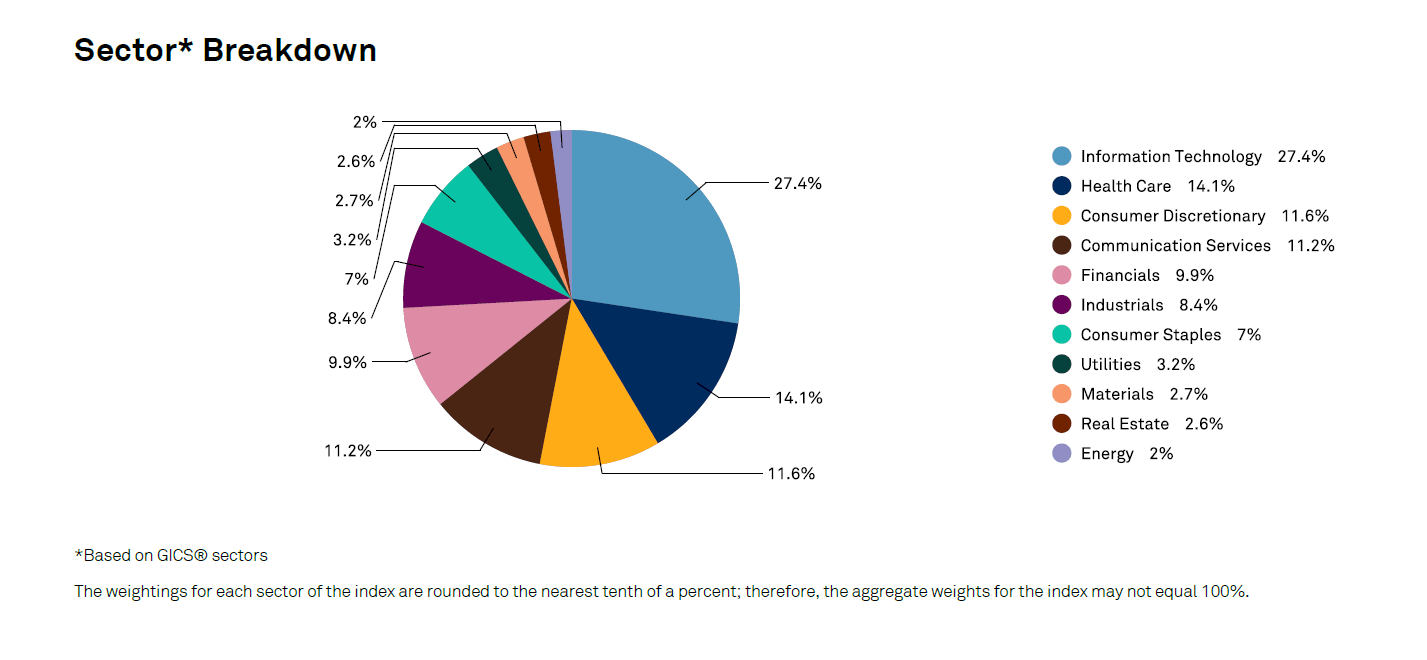

Another perspective on the concentration in the US equity market can be found in the S&P 500. As of Oct 30th, IT constitutes over 27% of the index as shown in the following chart:

Click to enlarge

Source: S&P

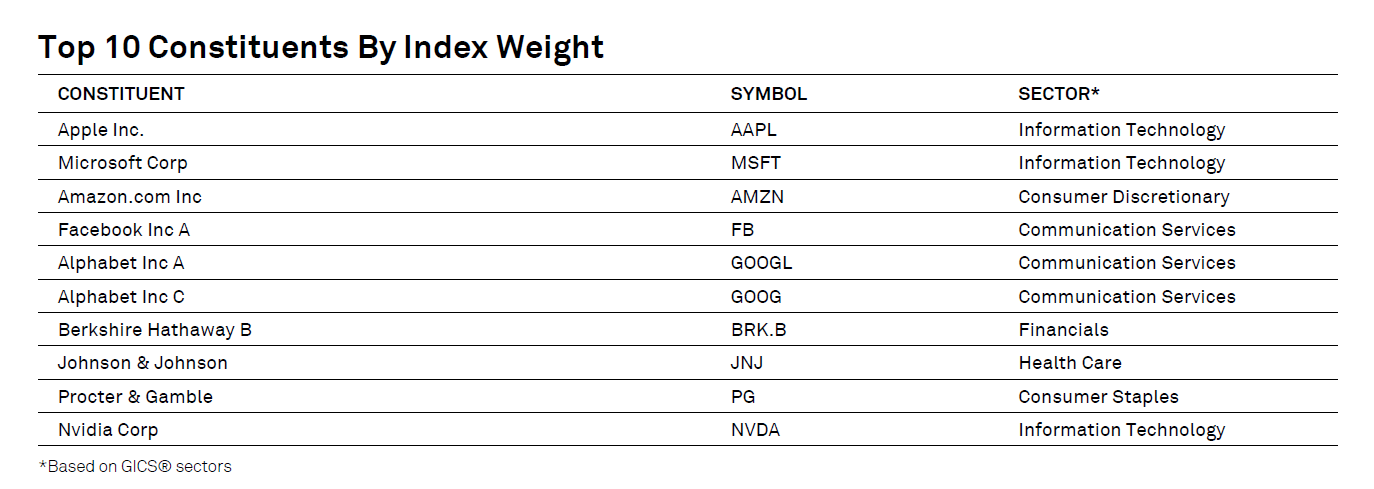

In addition, six of the top 10 companies in the index are tech companies:

Source: S&P

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No positions