I have written many times on this blog that US investors have to diversify their holdings across assets including owing foreign equities. The convention wisdom that American multinationals derive a substantial portion of their earnings form abroad and hence foreign stocks are not necessary to own does not necessarily hold true. However in recent years US stocks have outperformed foreign stocks by a significant margin. I came across the below fascinating fact in the latest article by Jason Zweig at the WSJ.

- The S&P 500 yielded an average of 8.7% annually higher than the MSCI World Ex-USA index over the past five years

- Over the past 25 years the S&P 500’s annualized return over the MSCI World Ex-USA index was 4.5%

Source: Blown Election Calls, the Stock Market and You, WSJ

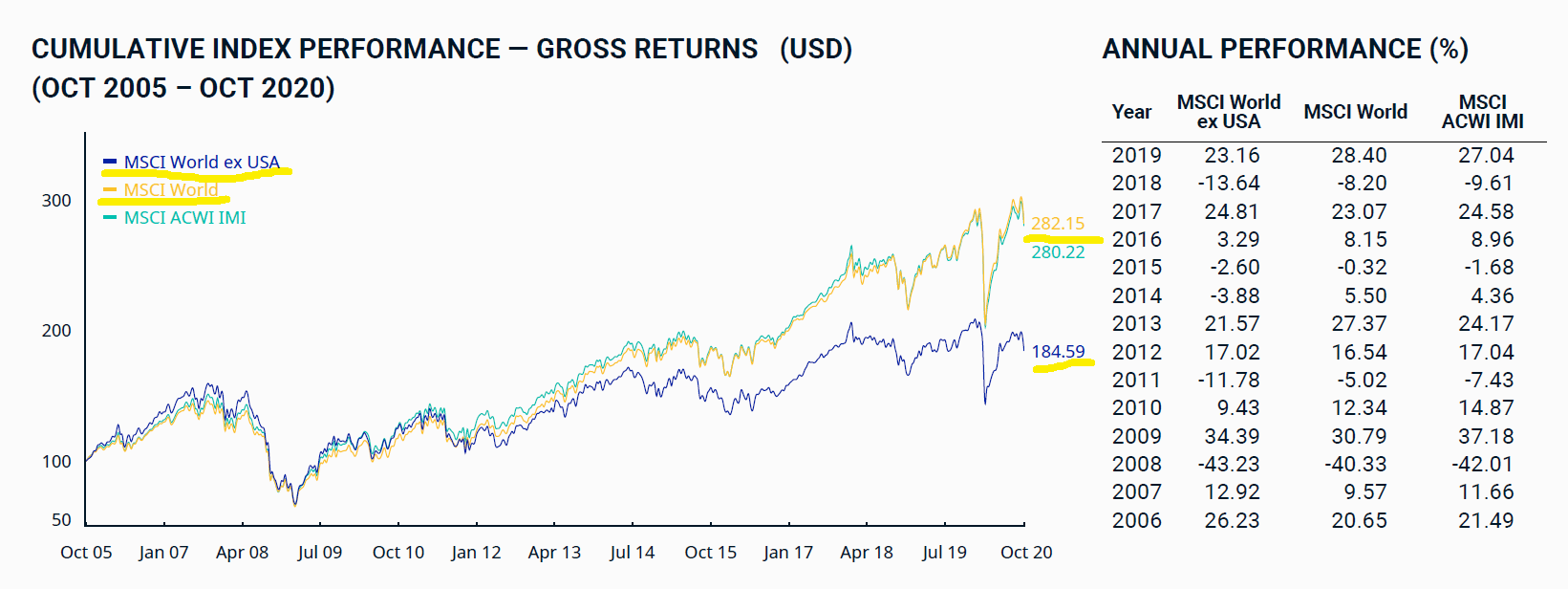

The following chart shows the wide gap in returns between the MSC World Index and MSCI World ex USA. The MSC World Index includes the US.

Click to enlarge

Source: MSCI

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- Vanguard MSCI Emerging Markets ETF (VWO)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard Developed Markets Index Fund ETF (VEA)

Disclosure: No Positions