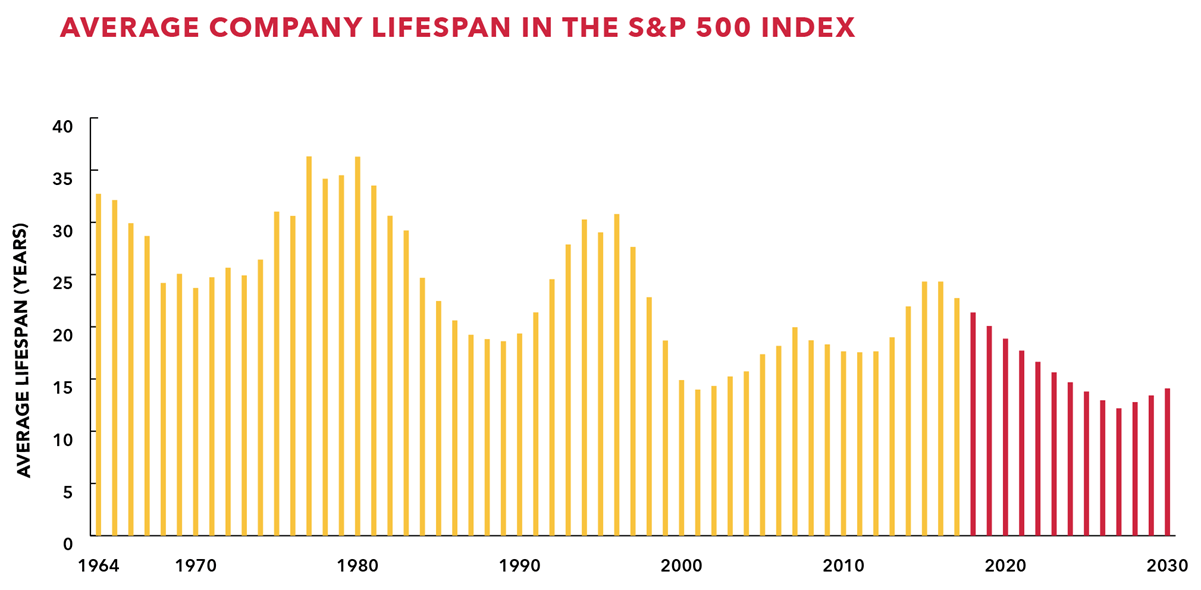

The average company lifespan in the S&P 5oo index is less than 20 years and falling compared to an average of 30 years in the 1960s. While there are many reasons such as buyouts, mergers, going private, etc. for this situation, one of the main reason is technological changes. As technology changes quickly today’s Amazon(AMZN) or Netflix(NFLX) or Apple(AAPL) will be replaced by others in the future.

But the bigger and more important implication of the declining lifespan in the S&P 500 is how does this impact long-term holding of equities?

Click to enlarge

Source: Buy and hold – Is it really that simple? by Duncan Macinness, The Ruffer Review, Investment Office

Related ETF:

- SPDR S&P 500 ETF Trust (SPY)

Disclosure: No Positions