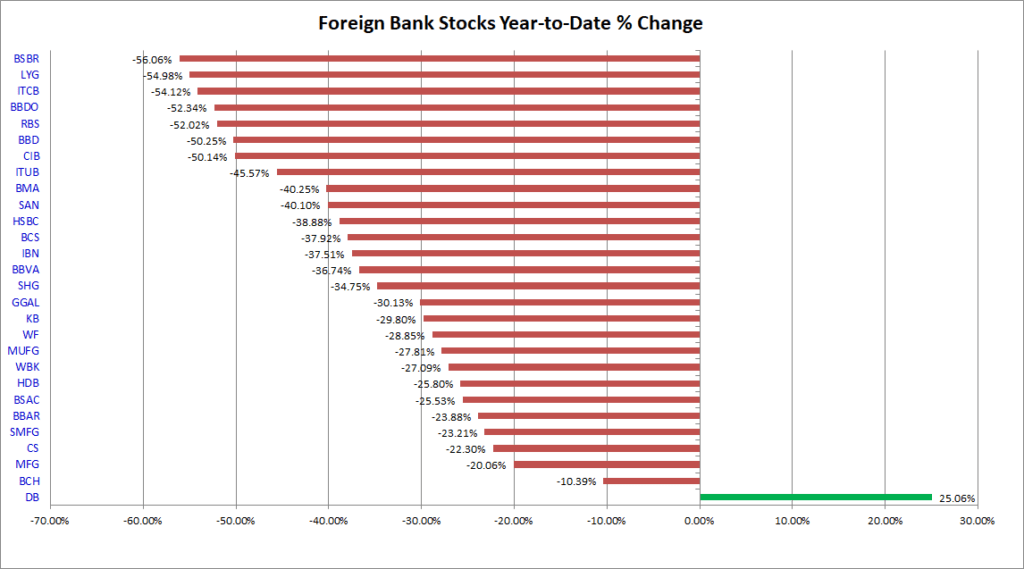

Foreign bank stocks listed on the US exchanges are down significantly so far this year. In fact, except Deutsche Bank, all these ADRs are in the deep red as shown in the chart and table below. Banco de Chile is the only bank ADR with a a relatively low loss of about 10%. Some of the banks are off by 50% or more. For example Bancolombia (CIB) of Colombia is down by mover 50%.From developed world banks to emerging world banks, all are in the negative territory.

Click to enlarge

Year-to-date returns of foreign bank stocks – Table:

| S.No. | Bank Name | Ticker | YTD % Change (as of July 13,2020) |

|---|---|---|---|

| 1 | Deutsche Bank | DB | 25.06% |

| 2 | Banco de Chile | BCH | -10.39% |

| 3 | Mizuho Financial | MFG | -20.06% |

| 4 | Credit Suisse | CS | -22.30% |

| 5 | Sumitomo Mitsui Financial | SMFG | -23.21% |

| 6 | Banco BBVA Argentina S.A. | BBAR | -23.88% |

| 7 | Banco Santander Chile | BSAC | -25.53% |

| 8 | HDFC Bank | HDB | -25.80% |

| 9 | Westpac Banking | WBK | -27.09% |

| 10 | Mitsubishi UFJ Financial | MUFG | -27.81% |

| 11 | Woori Financial Group Inc. | WF | -28.85% |

| 12 | KB Financial Group | KB | -29.80% |

| 13 | Grupo Financiero Galicia | GGAL | -30.13% |

| 14 | Shinhan Financial | SHG | -34.75% |

| 15 | Banco Bilbao Vizcaya Argentaria | BBVA | -36.74% |

| 16 | ICICI Bank | IBN | -37.51% |

| 17 | Barclays Bank | BCS | -37.92% |

| 18 | HSBC | HSBC | -38.88% |

| 19 | Banco Santander | SAN | -40.10% |

| 20 | Banco Macro | BMA | -40.25% |

| 21 | Itau Unibanco | ITUB | -45.57% |

| 22 | Bancolombia | CIB | -50.14% |

| 23 | Banco Bradesco | BBD | -50.25% |

| 24 | Royal Bank of Scotland | RBS | -52.02% |

| 25 | Banco Bradesco - Com | BBDO | -52.34% |

| 26 | Itau Corpbanca | ITCB | -54.12% |

| 27 | Lloyds Banking Group | LYG | -54.98% |

| 28 | Banco Santander Brasil | BSBR | -56.06% |

Source: BNY Mellon

Disclosure: Long many of the banks listed above including CIB