US stocks have roared back since the lows reached in March. None of the factors that would normally crush the market seems to have any impact on the market in the current scenario. Millions of unemployment people, a scary global pandemic, economic devastation to name a few seems to be nothing more than just noise to the market. Some are attributing the dramatic recovery in equity prices to the Fed printing unlimited amounts of money. Some others are stating that the unemployed Americans getting some extra $600 in unemployment, millennials living in basements of their parents’ using the Robinhood App and the work-from-home crowd are simply playing the market since they are bored at home. Obviously thousands of kids playing the market with $100 here and $1,000 there are NOT going to cause the market to boom like it did in the past few months.

With that said, the tech-heavy NASDAQ has shot up over 26% in the past 3 months and is up over 11% year-to-date. The market cap of already richly valued firms has exploded to even higher levels. The market caps of the five major firms on the NASDAQ Exchange are shown below:

- Facebook Inc (FB) – $674.0 Billion

- Apple (AAPL) – $1.5 Trillion

- Amazon(AMZN) – $1.3 Trillion

- Microsoft (MSFT) – $1.5 Trillion

- Alphabet Inc (GOOG) – $1.5 Trillion

The P/E ratios of these giants show they are not cheap. Facebook for example has a TTM of over 34. Amazon’s P/E is even worse at over 124.

It appears that some investors are actually assuming that these firms are benefiting from Covid-19. The thinking goes that millions of people sitting at home are simply ordering everything online from Amazon for instance and hence the growth for Amazon is infinite.

However extreme caution is needed when the crowds believe that stocks especially those in the tech sector can only go up.

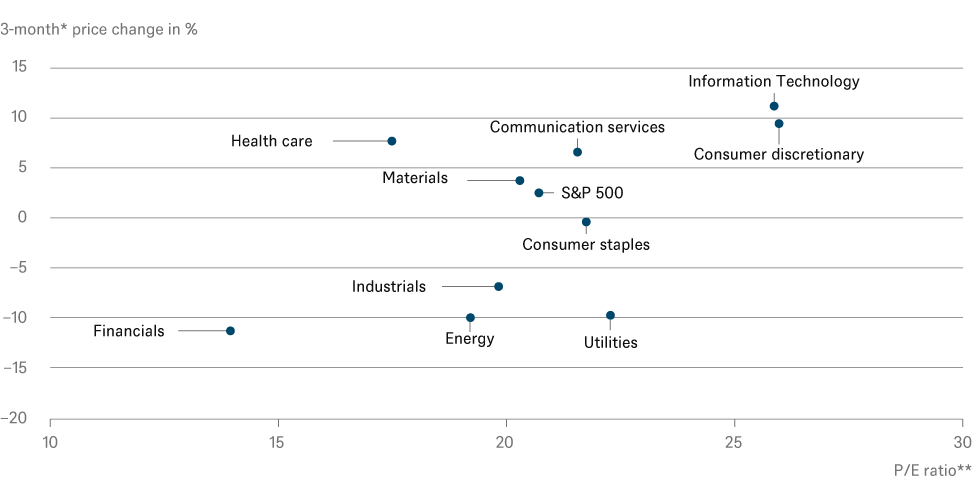

A recent article by folks at DWS shows that the already expensive sectors even more expensive after the three month rally:

Click to enlarge

Source: Expensive stocks become more expensive as cheap ones stay cheap, DWS

Hat Tip: David Stevenson: my take on six bull arguments for markets, CityWire

The two sectors with high P/E ratios that rose the most in the three months are: IT and Consumer Discretionary.

Key Takeaway:

Some of the mega-cap stocks in the NASDAQ were expensive even before the pandemic induced crash. They are now trading at much higher levels in terms of stock prices and their market caps have ballooned accordingly. So investors need to remain cautious and not buy these stocks just because they keep going up.

Disclosure: No Positions