Viral outbreaks such as the current COVID-19 Coronavirus is not new. We have had many viral outbreaks in the past which all went away after some time. One important difference between COVID-19 and other viruses like Zika, SARS, Ebola, etc. is that most the western world were not impacted by them – at least in a scale we are seeing now. Ebola mainly affected Africa. SARS affected a few developed countries such as Canada but the US was mostly untouched by it. Despite these differences even COVID-19 will pass and things will get back to normal. China seems to slowly getting back to normal as the following articles note:

- As coronavirus epidemic eases in China, life is slowly returning to normal, SCMP, Mar 15, 2020

- Coronavirus: Is China getting back to business?, BBC, Mar 11, 2020

- China’s New Normal, Foreign Policy, Mar 11, 2020

But China put some 60+ million people under strict quarantine before the virus peaked. A similar scenario will play out in Europe and the US before the virus goes away.

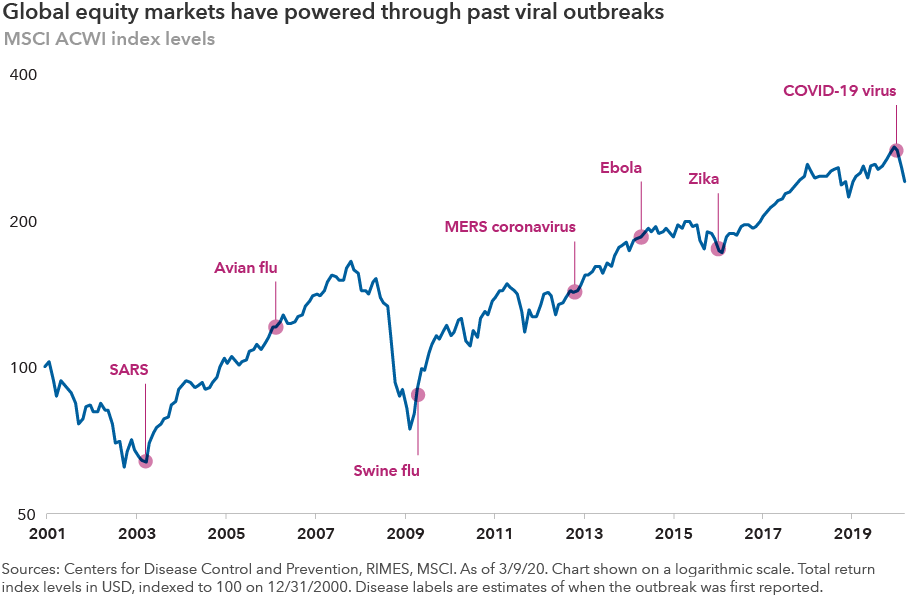

That said, I recently came across another chart showed the performance of global equity markets after past viral outbreaks. This chart is similar to the one posted by a Schwab article before. The below chart is from an article by Tim Armour of Capital Group:

Click to enlarge

Source: Capital CEO Tim Armour on weathering the coronavirus, Capital Group

Earlier:

So the key takeaway for investors is this too will pass eventually. The main thing is not to panic and be patient. Nobody knows how worse things will get before normalcy returns.