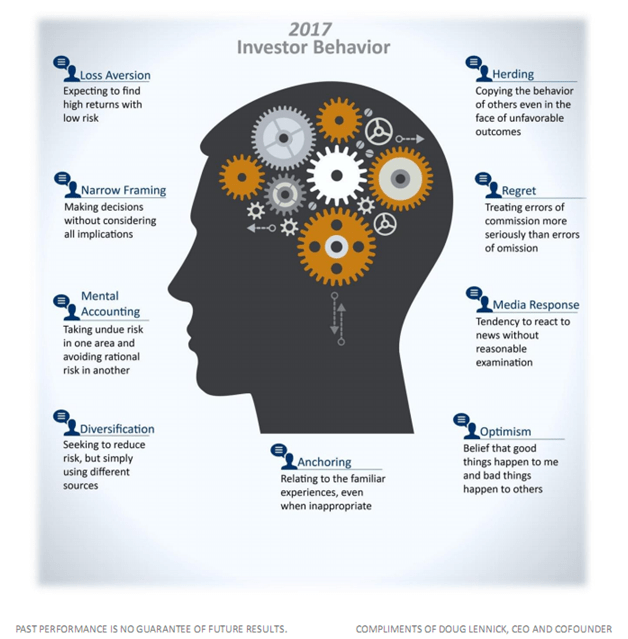

In an earlier post I discussed how the enemy of investors are themselves. Following that same topic, the following infographic shows 9 investor behaviors that are detrimental to their decision making skills and ultimately leads to poor investment returns.

Click to enlarge

Source: Unknown

“Narrow Framing” is one of the bad behaviors that some investors are prone to have. Under this theory, investors tend to frame everything narrowly without looking at the big picture or the overall implications. For example, an investor might sell out all British stocks because of Brexit fears when in fact most of the firms in the FTSE 100 derive their earnings from abroad and are not totally dependent on the domestic economy. Another example, is an investor that totally avoids Canadian and Mexican equities because of trade wars with the US. If the investor considers the overall big picture, it will be clear that these two countries are the some of the biggest trading partners with the US and hence avoiding firms from there is not a wise strategy.

Simply reacting to media without understanding the real implications of an event is also a bad behavior.