The American middle is going deeper into debt to maintain their middle class lifestyle, according to an article in the journal earlier this month. The article discusses a few sample families that are struggling to stay in the middle class. One of the main reasons for the current state of the working class is that incomes have not kept up with expenses. To put it differently, the rate of rise in income is much lower than the rate of increase of other essential items like shelter, health care, college education, etc.

So how does the US middle class continue to maintain their standard of living?

Credit.

Credit is available for pretty much anything. From cars to homes US families tend to put a lot of household expenses on credit. For example, consumer debt excluding mortgages total $4 Trillion and student debt stands at $1.5 Trillion.

The following is an excerpt from the piece:

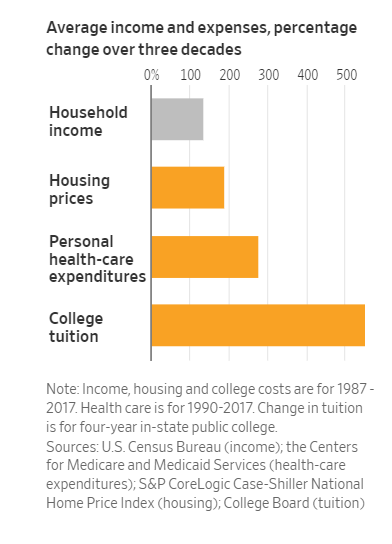

Median household income in the U.S. was $61,372 at the end of 2017, according to the Census Bureau. When inflation is taken into account, that is just above the 1999 level. Without adjusting for inflation, over the three decades through 2017, incomes are up 135%.

Average tuition at public four-year colleges, however, went up 549%, not adjusted for inflation, according to data from the College Board. On the same basis, average per capita personal health-care expenditures rose about 276% over a slightly shorter period, 1990 to 2017, according to data from the Centers for Medicare and Medicaid Services.

And average housing prices swelled 188% over those three decades, according to the S&P CoreLogic Case-Shiller National Home Price Index.

“The costs of staying in the middle class are going up,” said Adam Levitin, a Georgetown Law professor who studies bankruptcy, financial regulation and consumer finance.

Source: Families Go Deep in Debt to Stay in the Middle Class, WSJ, Aug, 2019