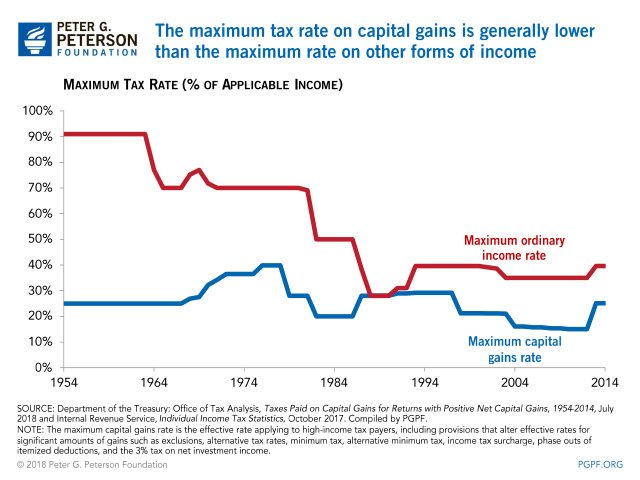

The Maximum Tax Rate on capital gains has always been lower than the rate on ordinary income in the US. This preferential treatment on capital gains is one reason US companies and investors are contend with lower dividends paid out by companies. Another impact is that an investor holding stocks over many years and selling them after they have multiplied many times over will pay lower taxes in terms of capital gains. This is another factor that long-term investors should consider when making equity investments.

Click to enlarge

Source: Peterson Foundation