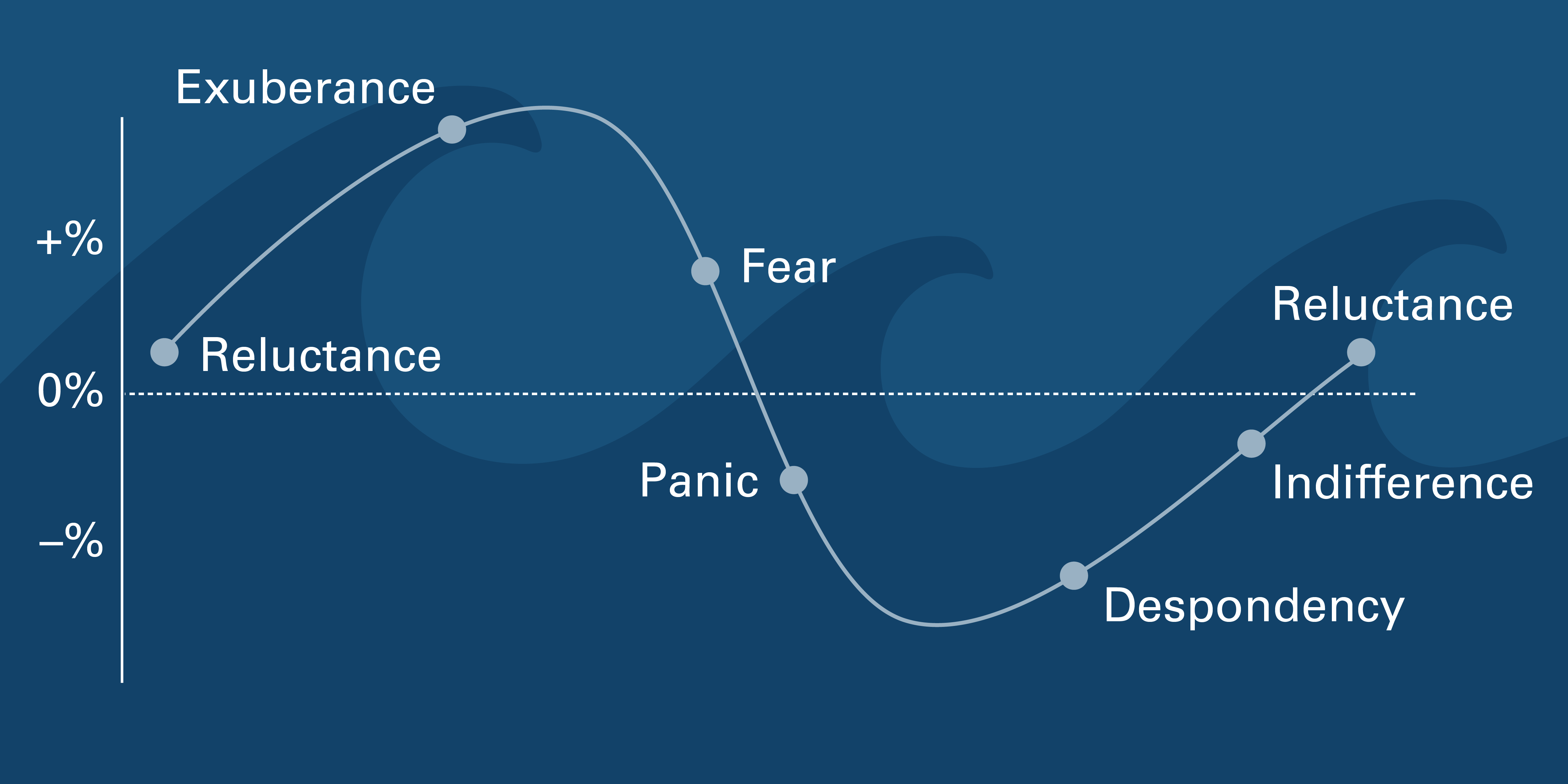

Investing in the equity markets is hard and is even harder to become successful at it. One of the main variables that affects investors’ performance is emotion. Keeping emotions under control and being calm when markets are rough is easier said than done. However investors who are able to withstand severe corrections and bear markets, are most likely to be rewarded for their risk with much higher returns. I came across the following simple chart that shows the various stages that investors go through:

Click to enlarge

Source: Chart of the Month: Emotions and investing – they don’t go hand in hand, Vanguard UK

From the above piece:

Our chart shows the emotional cycle that most investors go through, starting and ending with reluctance, where the fear of taking a risk and getting it wrong is stronger than the fear of missing out. Most people tend to feel the pain of losing a certain amount more than they would enjoy the pleasure of gaining the same amount, so overcoming reluctance is an important first step towards investing.

Once a rally has established itself and you are over your reluctance, exuberance can come into play. This often translates into investing heavily at what can end up being the market peak. You may end up nursing heavy losses and feel too despondent or scared to invest again.

Markets never move entirely in one direction and market cycles are part and parcel of investing. For a successful investing experience, keep focused on your long-term investment goals and don’t be distracted by emotions. The important thing to remember is that emotions and investing don’t go hand in hand.

When markets plunged during the Global Financial Crisis(GFC) of 2008-09 many retail investors bailed out of stocks entirely and took huge losses. These people waited for a perfect time to get back in but was too late to join the party before stocks took off like a rocket. Many simply abandoned the markets never to deal with it again. Unlike these people, those that held on to their holdings during those dark days simply rode out the bear market and recovered all their losses and then made gains.

Similarly in recent years the clamor for internet stocks particularly the FAANGs have been astonishing. As they soared higher and higher the demand for these internet 2.0 giants only grew more. However we all know that the higher these stocks go the harder they fall. So caution is warranted at current levels. Simply trying to catch the dot com wave now is not a wise strategy.