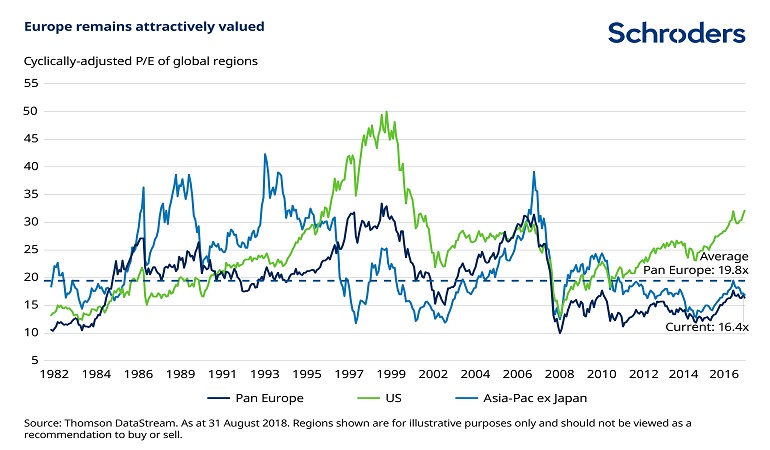

European equities are attractive relative to their US peers based on cyclically-adjusted price-to-earnings ratio (CAPE) according to an article by Rory Bateman at Schroders. The following chart shows the comparison of valuations since 1982:

Click to enlarge

Source: Can European equities play catch-up in Q4?, Schroders

A short excerpt from the above article:

In summary, we are encouraged by the recent rotation in the market favouring more cyclical value stocks and moving away from expensive defensives.

The overall market valuation remains attractive with the cyclically-adjusted price-to-earnings ratio (CAPE) trading 20% below historical averages. The massive performance differential versus the US has recently begun to close and we expect this to continue.

Markets remain susceptible to volatile periods and we would suggest investors be opportunistic and take advantage of this volatility to buy assets that become mispriced.