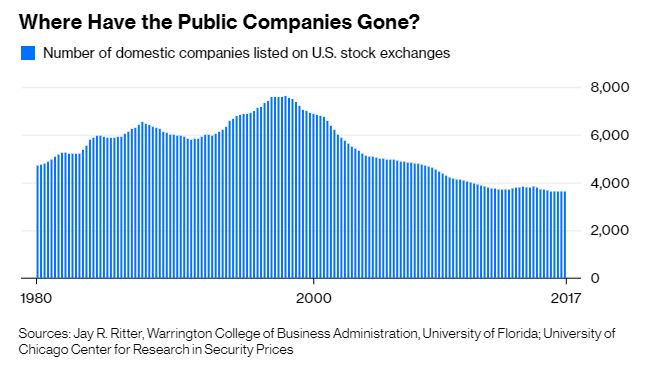

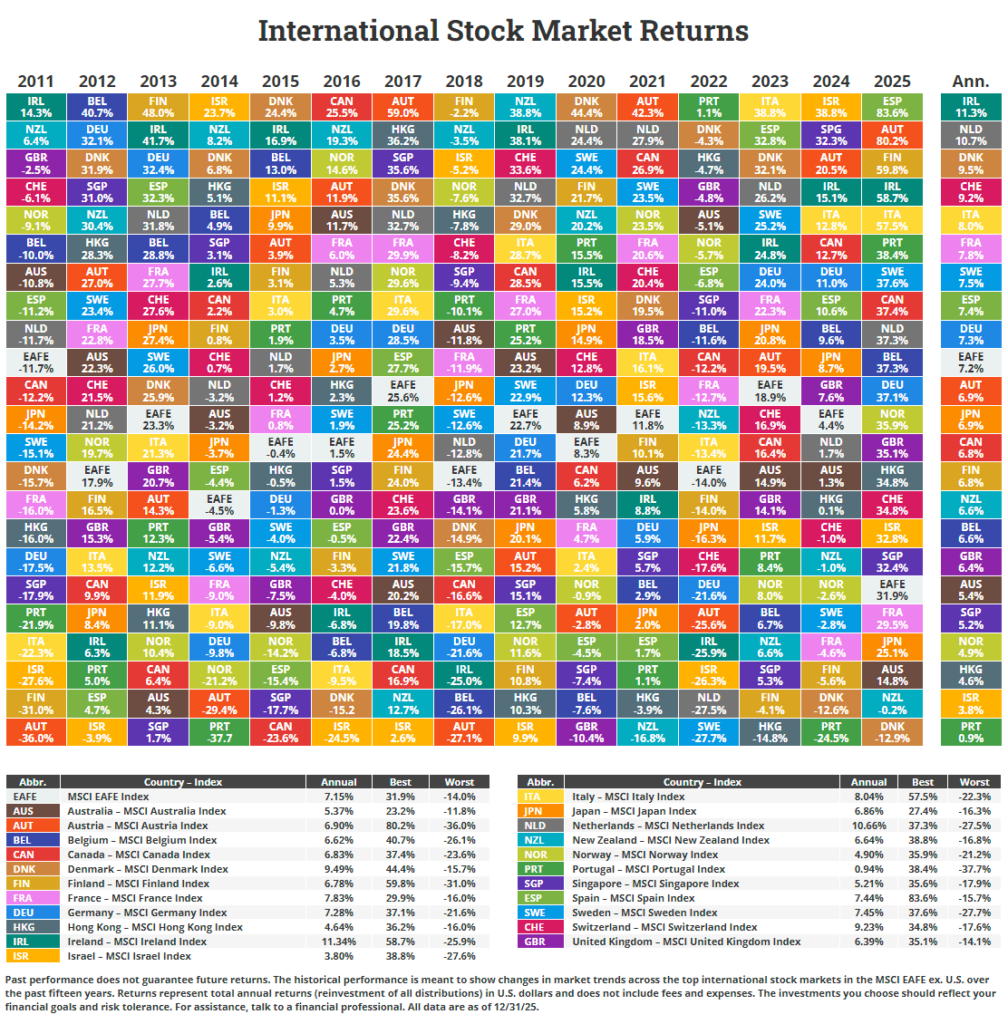

The number of publicly-listed US companies continues to decline each year. From a peak of over 7,600 in 1997 the number has shrunk to about 3,600 at the end of 2017. That is a reduction of over 50%.

Click to enlarge

Source: Where Have All the Public Companies Gone?, April 8, 2018, Bloomberg

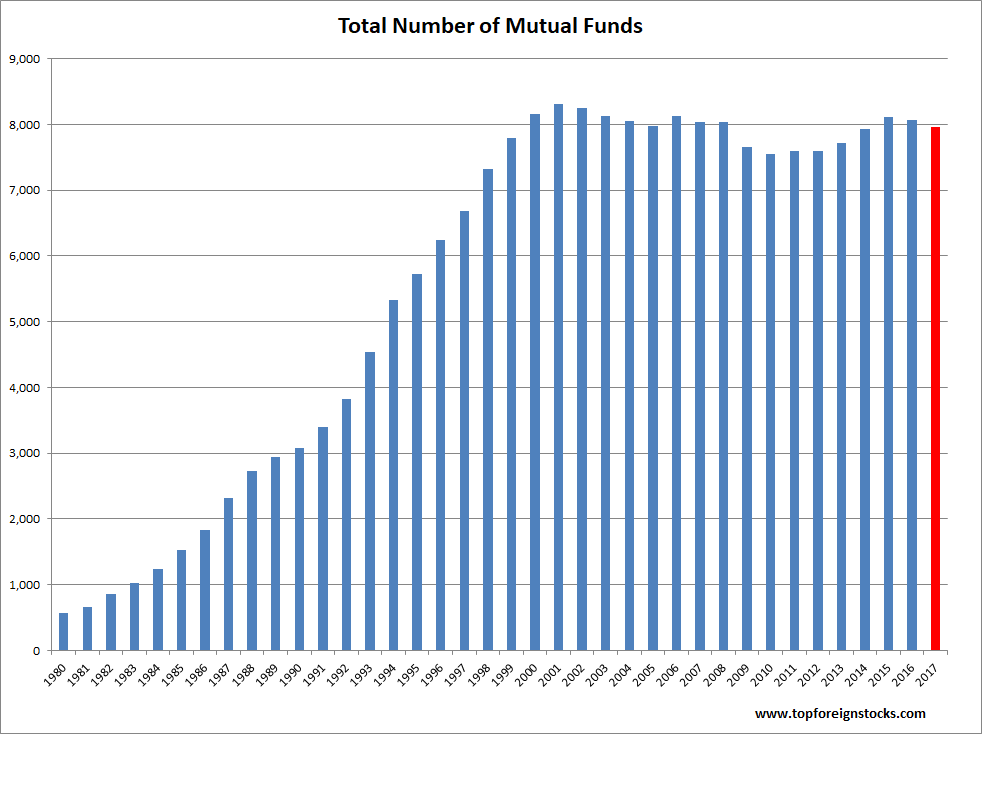

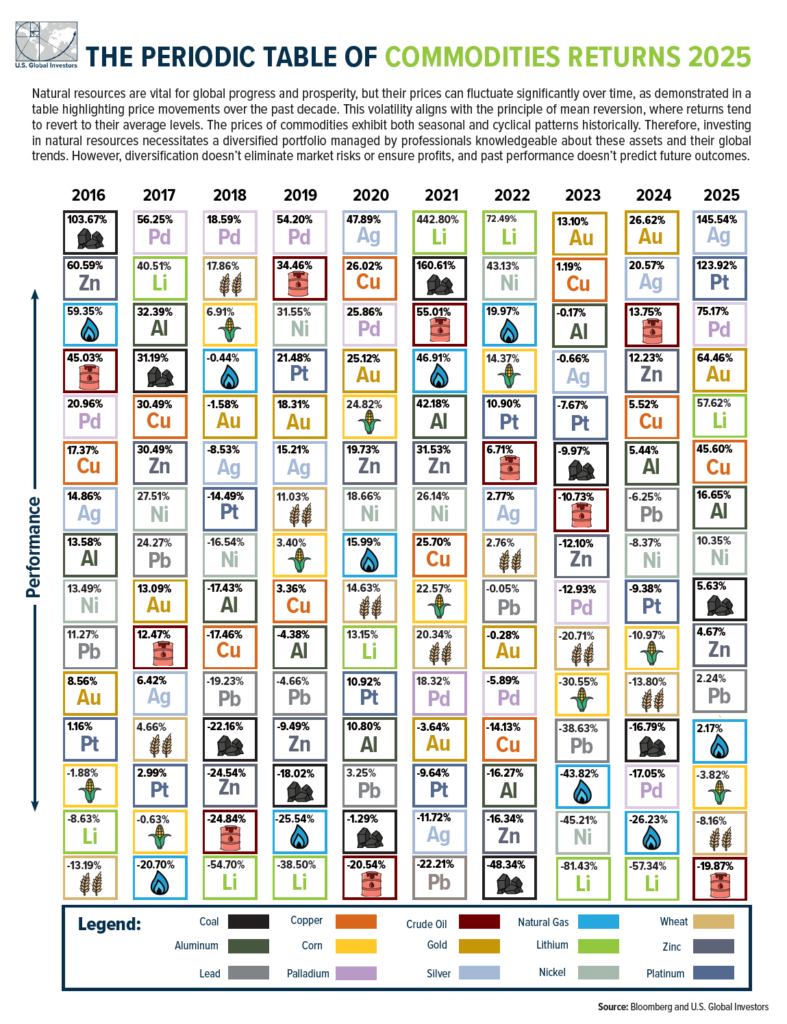

Despite the fall of public companies, the number of mutual funds available in the market has exploded in the past few decades and remains high. At the end of 2017, nearly 8,000 mutual funds existed in the US market as shown in the chart below. To put this number in perspective, there were only 361 funds in 1970. Then the number jumped to 564 in 1980. Since then the number of funds have steadily increased year over year until the dot-com crash of early 2000 and the global financial crisis of 2008-09.

Click to enlarge

Data Source: 2018 Investment Company Institute Fact Book

Note: The above figure includes equity, debt and money market funds.

There were a total of 4,706 pure equity funds at the end of last year.

Mutual funds typically have high expense ratios in the range of 1.20% to 1.50% on an average. Many funds have much higher fees than these ratios. Investors looking to avoid these high fees can consider index funds or ETFs.