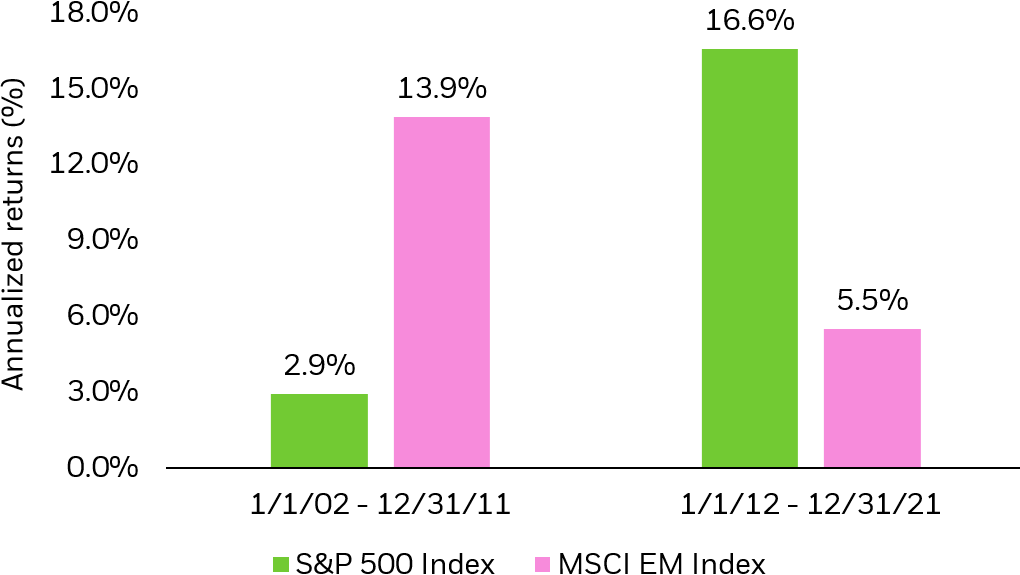

Emerging market banks offer distinct advantages over their developed world peers. Other than the obvious diversification benefits, banks in the developing countries tend to have higher growth and profitability rates leading to much better share price appreciations. For instance, in most developing markets a few banks dominate the industry and hence have higher pricing power.

I came across an April article by Tan Van Nguyen and Justin Leverenz at Oppenheimer Funds discussing their strategy for picking EM bank stocks. They identified four factors that determine their investment philosophy. I believe the first factor is more important than the others. From the article:

1. Market Structures Matter Enormously

A concentrated market structure gives banks pricing power, allowing them to consistently generate returns above their cost of capital. Banking is an economy-of-scale business where the largest lenders enjoy inherent advantages in low funding costs, better risk-adjusted net interest margins (NIMs), and superior return on assets (ROAs). Exhibit 1.

Few banks in the world operate in such attractive market structures as Russia and Peru, where the leaders Sberbank and Credicorp control between 30% and 50% of the assets in the banking system. With their extensive branch networks and entrenched brand awareness, these are the go-to banks for customers’ deposits. This explains their competitive risk-adjusted NIMs and their long-term, superior ROAs of 2.0%-2.5%.

Source: Secrets from the Vault: How We Invest in EM Banks, Oppenheimer Funds

Seven emerging market banks trading on the US markets are listed below with their current dividend yields for further research:

1.Company:Banco Santander- Chile (BSAC)

Current Dividend Yield: 4.60%

Country: Chile

2.Company: Banco de Chile (BCH)

Current Dividend Yield: 3.35%

Country: Chile

3.Company: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.52%

Country: India

4.Company: Credicorp Ltd (BAP)

Current Dividend Yield: 1.87%

Country: Peru

5.Company: Bancolombia (CIB)

Current Dividend Yield: 3.48%

Country: Colombia

6.Company: Nedbank Group Limited (NDBKY)

Current Dividend Yield: 5.04%

Country: South Africa

7.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield: 4.81%

Country: South Africa

Note: Dividend yields noted above are as of July 25, 2018. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long CIB and BCH