Eurozone stocks are not expensive relative to their US peers based on Cyclically Adjusted Price to Earnings ratio according to an article by John Oliver at AMP Capital, Australia. He discussed four reasons on why Eurozone stocks are attractive at current levels. From the article:

Eurozone shares remain attractive

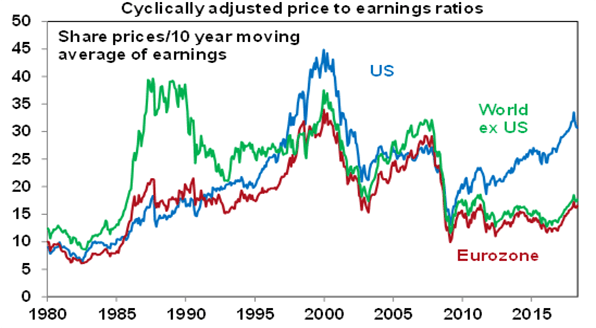

While question marks remain over Italy and this will weigh on the Euro, there is good reason to be optimistic regarding Eurozone shares. First, Eurozone shares are not expensive. They are trading on a price to forward earnings multiple of 14 times which is around its long-term average. And their cyclically adjusted price to earnings ratio which compares share prices to a ten-year moving average of earnings (often called a Shiller PE) is around 17 times compared to 32 times in the US. This is largely because Eurozone shares underperformed US shares in the post GFC period. Adjusting for relatively lower bond yields in Europe makes Eurozone shares even more attractive.

Source: Global Financial Data, AMP Capital

Second, the European Central Bank is still pumping cash into the economy and is a long way from rate hikes. Italian risk may keep it easier for longer. This contrasts to the Fed which is engaging in quantitative tightening and raising interest rates.

Third, the Euro is now falling. A rise in the Euro through last year – as Eurozone growth surprise on the upside relative to the US and political risk declined in the Eurozone relative to the US – harmed Eurozone shares. This is now reversing as US growth has started to accelerate relative to the Eurozone.

Finally, while Eurozone growth has slowed a bit it’s still good and thanks to ongoing monetary stimulus and a now falling Euro is likely to remain so. In turn this is good for profit growth.

Source: Italy is a worry – but 3 reasons not to be concerned about an Itexit, AMP Capital

Below are three points to remember before jumping into Eurozone equities:

- US stocks have always commanded a premium relative to European stocks as American firms’ growth potential is usually higher.

- Though Eurozone stocks are lagging in recent years they have beaten US stocks in the past in some years.

- Eurozone stocks tend to have higher dividend yields than their American peers but for US investors dividend withholding taxes can take a substantial bite out of the yields.