The US equity market has performed well in the past few years easily beating foreign developed markets especially developed Europe. Some investors may wonder if this is the right time to move out of domestic stocks and buy international stocks. For example, major European markets are flat or in the red so far this year. With fears of Italy going the way of Greece, further declines are possible.

One theory holds that European under-performance won’t last long and they will catch up with American equities. However another theory is that US companies are always ahead in everything and they command a premium over their European pears. Since European stocks are cheap relative to US, should you invest in other developed markets now?. According to an article by Charles Roth at Thornburg Investment Management, US equities may continue to outperform for some more time. He suggests that investors need not rush into international stocks at this time.

From the article:

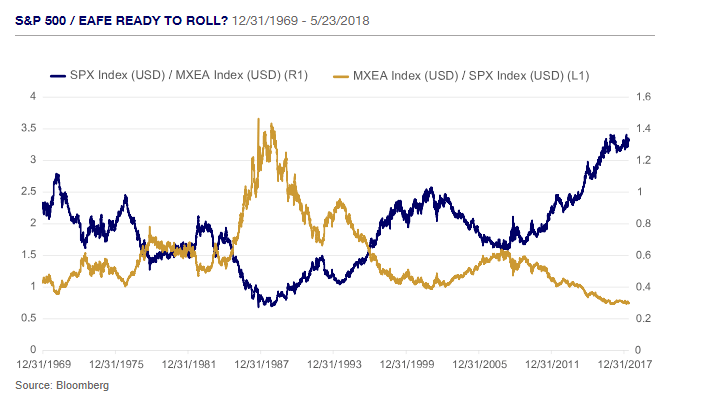

Lately, we’ve seen charts depicting the alternating outperformance of the S&P 500 Index (SPX) and the MSCI EAFE Index (MXEA) over the last four decades, with recommendations for investors to shift into international equities.

A case can easily be made to transfer money out of the U.S. to international and emerging markets equities based on relative valuations and earnings outlooks amid the differing stages in each region’s earnings cycles. But who’s to say that the S&P 500 Index’s outperformance of the EAFE is set to roll over? It’s been underway since November 2007, or for 10.5 years. Yet the longest observation of this alternating outperformance over the last 40 years was the S&P 500 Index’s 11.5-year run over the EAFE from February 1989 to August 2000. In other words, there could be room to run.

Rather than generic rebalancing out of sectors or regions, investors would be better served maintaining meaningful, long-term allocations to core asset classes. That includes factor exposures such as value and growth, not to mention market capitalization sizes. Why? Because these, too, can change over time. Despite the conventional wisdom, it’s been quite a while since value stocks have outperformed growth stocks. And while U.S. small caps in the Russell 2000 Index have beat their bigger S&P 500 Index cousins in the 10- and 20-year timeframes, they lag over the one-, three-, five- and, tellingly, 30-year periods.

It’s also worth noting that most large-cap constituents in the S&P 500, EAFE and EM indices are multinationals. So they may be domiciled in a particular region, but potentially source much or most of their revenue outside their home market.

Source: Portfolio Allocation When Safe Havens Get Stormy, Thornburg

From a related article:

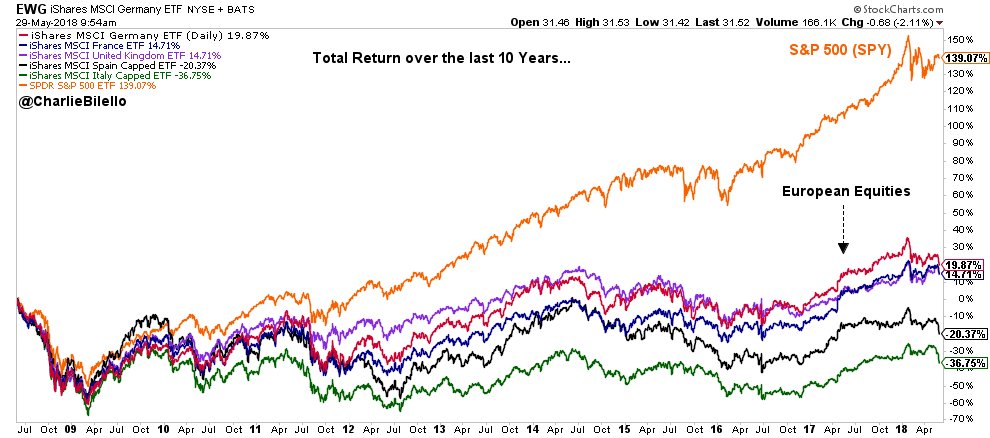

US: +139% Germany: +20% France: +15% UK: +15% Spain: -20% Italy: -37%

The S&P 500 has nearly tripled (up 194% to be exact) since its low point on March 9, 2009. The surge reflects America’s recovery from the Great Recession.

Yet the bull run has slowed considerably, especially in 2016. Stocks started the year with a scary plunge that was fueled by fears of a new global recession and worries about the downsides of cheap oil. Some even feared the bull market was near its death bed.

“The more fun part of the bull market is probably over,” said Russ Koesterich, global chief investment strategist at BlackRock. “It doesn’t mean stocks can’t advance. But the gains are going to be more muted — and accompanied by more volatility.”

Still, the market freakout of 2016 highlights the serious challenges facing the bull market as it grows older.

Source: Unkown

Related ETFs:

Disclosure: No Positions