The MSCI Emerging Markets Index is one of the most popular indices that track emerging markets. The index gives exposure to represents 846 large and mid cap stocks from 24 emerging markets. Many products such as ETFs and mutual funds use this index as a benchmark. For example, the iShares MSCI Emerging Markets ETF(EEM) which has over $42.0 billion in assets tracks the performance of the index.

At a high-level the MSCI Emerging Markets Index seems to be well diversified since it has over 800 firms and 24 countries. However that is not the case. The index suffers from three concentration risks. They are country risk, sector risk and company risk. Much of the index performance is driven by a handful of companies in a few sectors from a few countries.

1. Country Risk:

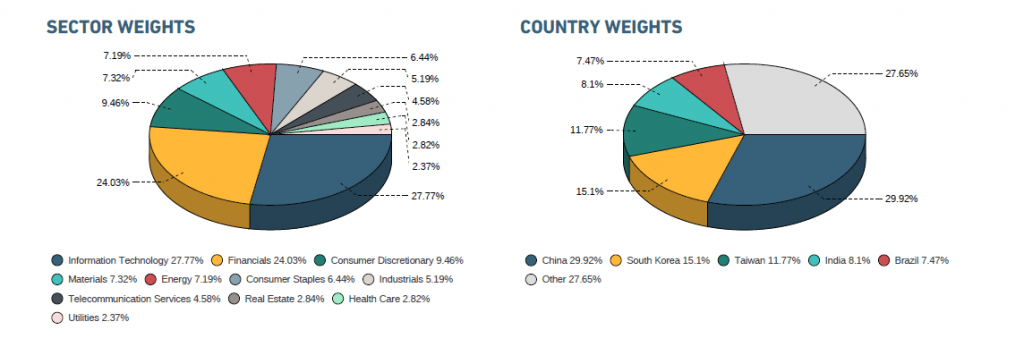

Though the index represents 24 countries allocation is not equally distributed among all the countries. About 60% of the allocation is assigned to just 3 countries – China, South Korea and Taiwan. So political uncertainties or economic issues in these countries will have larger impact on the index. So country risk is an important factor that emerging markets investors to have keep in mind.

2. Sector Risk:

The index also suffers from sector risk in that just two two cyclically growth oriented sectors dominate the index.Information Technology and Financials account for 52% of the index. Both these sectors are volatile sectors and go thru boom and bust cycles. So investors in ETFs such as EEM are more exposed to these sector than they may realize.

3. Company Risk:

Despite the index being made up of 846 firms, the top 10 alone account for 25% of the index. Of those 10 firms, 8 are from IT and the Financial sector. In addition, 5 stocks in the index have 20% of the weight. Hence these handful of firms have a much higher impact on the index performance than others. Any adverse or catastrophic problems at these firms will affect the index performance more.

The composition of the index in Feb, 2018 is shown below:

Click to enlarge

Source: EM: A Cautionary Tale of Concentration by Michael J. LaBella, Legg Mason

The following chart shows the country and sector weights at the end of first quarter 2018:

Source: MSCI

The key takeaway for investors is that concentration risk is real. Investors have to look under the hood before assuming an ETF offers diversification. During the dot-com crash investors with heavy exposure to tech stocks got wiped out and during the most recent financial crisis, those with large concentrated allocations to real estate and financials lost heavily.

Related ETFs:

Disclosure: No Positions