The S&P 500 Index is the benchmark index of the US equity market. Billions of dollars are invested in various products tracking the index.

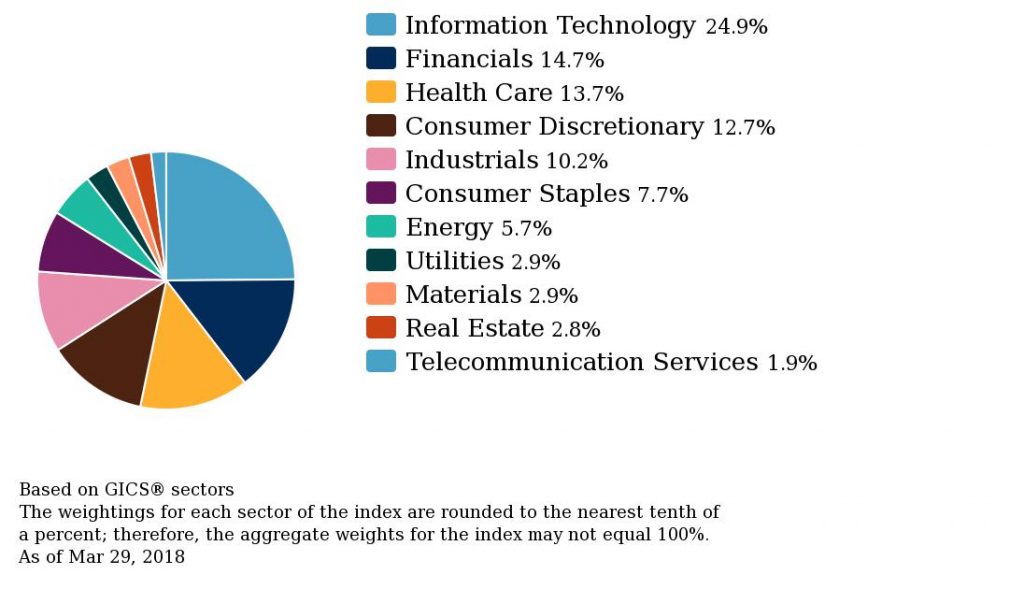

The sector breakdown of the S&P 500 is shown below:

Click to enlarge

Source: S&P Indices

The tech sector dominates the US equity market. No other country in the world can match the technical innovation and power of the Silicon Valley. From Alphabet(GOOG) to Facebook(FB) to Amazon(AMZN) and other firms in between all the top tech firms are located in the US. Even developed European are unable to compete against American firms in the tech sector. That is why there is no European Google or European Facebook for example.

Many of the large-cap US firms are multi-national firms with huge operations in foreign countries. Hence the revenue exposure of S&P 500 firms to overseas markets is high.

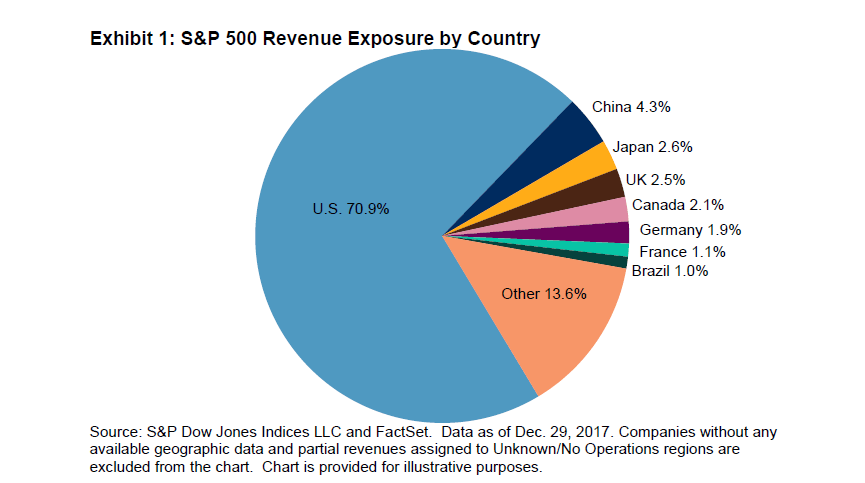

The following chart shows the revenue exposure of S&P Revenue Exposure by Country:

Source: The Impact of the Global Economy on the S&P 500 by Phillip Brzenk, S&P Global

The US is the main market for S&P 500 firms accounting for 71% of their revenues. The remaining revenue come from foreign countries. China, Japan and the UK are top three countries in terms of revenue exposure. Though Mexico has large trade ties to the US, it does not appear in the top revenue exposure countries.

Which S&P 500 sectors have the most and least exposure to foreign countries?

The tech and materials sector have the highest revenue to overseas markets. Companies such as Intel(INTC), Alphabet(GOOG), etc. dominate in the global tech space. Similarly material firms such as miners and oil producers have large operations overseas.

The sectors with the least revenue exposure to foreign markets are the real estate, telecom and utilities. So the performance of companies in these sectors mostly depend on the health of the US economy than the economy of other countries.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions

See also:

- How Global Is the S&P 500?, Indexology Blog