Emerging equity markets tend to offer higher returns than developed markets during some periods but not all the time. Emerging markets also go thru boom and busts like the developed markets but the magnitude of rise and fall in those markets is much higher than their developed world peers.

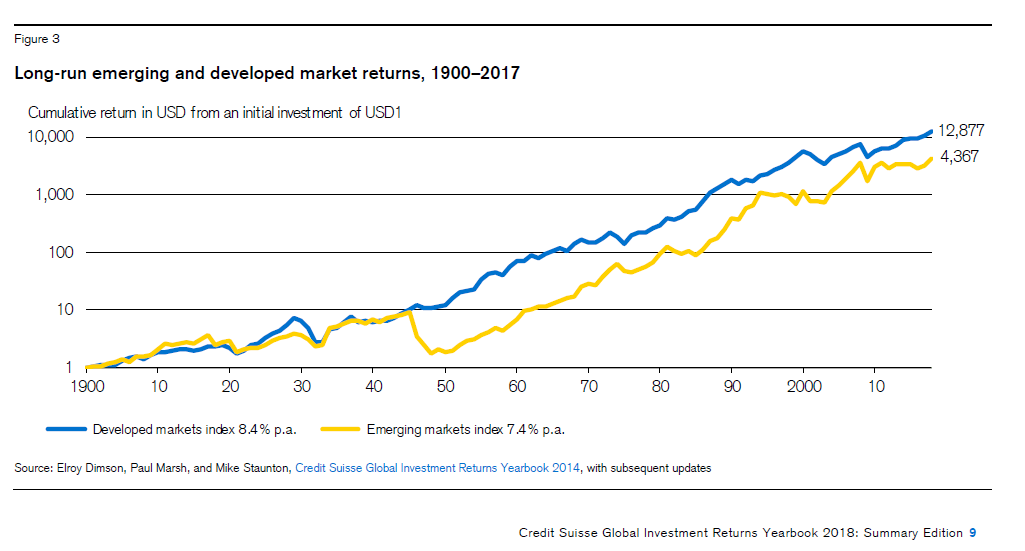

In the really long run emerging markets under-perform developed markets in terms of returns. Emerging markets returned 7.4% per year compared to 8.4% for developed markets according to Credit Suisse Global Investment Returns Yearbook. From the 2018 edition of the popular study:

Figure 3 shows the long-run performance of emerging versus developed markets. In the early part of the 20th century, emerging markets outperformed, but were hit badly by the October 1917 Revolution in Russia, when investors in Russian stocks lost

everything. During the global bull market of the 1920s, emerging markets underperformed, but they were affected less badly than developed markets by the Wall Street Crash. From the mid-1930s until the mid-1940s, emerging-market equities moved in line

with developed markets.

Source: Credit Suisse Global Investment Returns Yearbook 2018