Electric automaker Tesla(TSLA) has become one of the most valuable auto companies the world. Investors are highly attracted to the company’s stock for its growth potential. In this post, let’s take a quick look at how Tesla compares with the Japanese auto giant Honda.

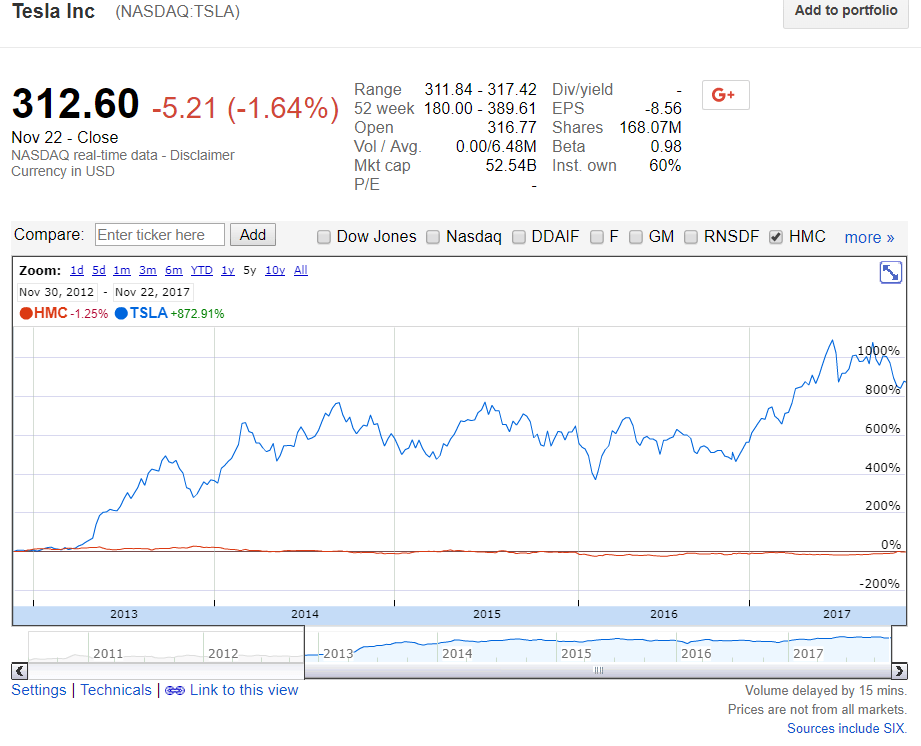

Equity investors in Tesla have enjoyed phenomenal gains. The firm’s stock is up 43% year-to-date compared with just 13% for Honda Motor Co. Ltd(HMC). In the past five years, TSLA has shot up an astonishing 873% while HMC is basically flat as shown in the chart below:

Click to enlarge

Source: Google Finance

In the past 10 years, TSLA has soared 1,528%. However it should be noted that Tesla is a highly volatile stock.Even a small negative news has a substantial adverse on the stock price.

Ben Preston of Allan Gray published an article titled “Finding value in an over-valued world”. From the piece:

Honda vs Tesla

Graph 1 compares the market capitalisation and revenue of Honda and Tesla. It is remarkable that investors have allowed themselves to be so convinced of Tesla’s future success that they are now saying Tesla is worth more than the whole of Honda, even though Honda has 10 times the revenue. Bear in mind that in a decade of existence, Tesla has never been profitable. And, in the last four decades, Honda has never been unprofitable.

It is important to acknowledge that Honda’s earnings have historically been cyclical. The company experienced a big decline in earnings from the mid-80s to the mid-90s, and again in the global financial crisis. But even during those periods, Honda’s shares have only rarely – and only very briefly – traded for less than tangible net asset value. On average, its shares have traded at a 50% premium to net asset value, but today investors can buy them at a 10% discount. In the context of a stock market that looks quite expensive overall, Orbis believes that Honda shares look like pretty good value.

Source:Finding value in an over-valued world, Allan Gray

Obviously Tesla is a high growth company and Honda is a stable well-established slow grower. Clearly investors are willing to pay a premium for fast growing firms even of they are not profitable.

Disclosure: No Positions