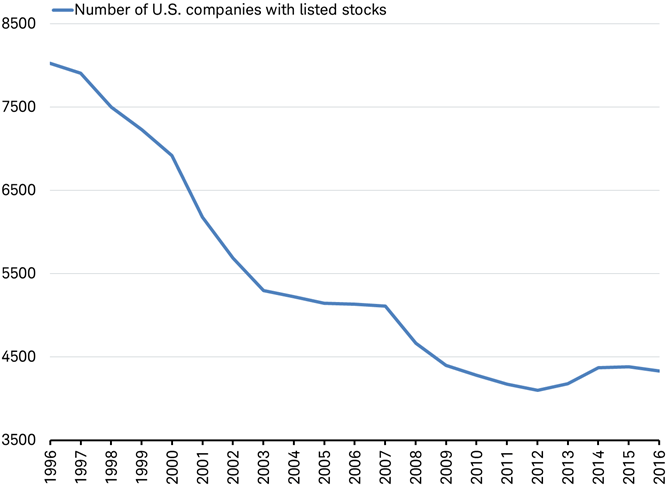

One of the reasons for the current bull market in US equities is the limited number of publicly listed companies. As more and more cash enters the market chasing a declining number of firms leads to more concentration. The chart below from a recent article at Schwab shows the dramatic fall in the number of public US firms since 1996:

Click to enlarge

Source: Charles Schwab, World Bank data as of 10/29/2017.

Source: Spirit of the Season: Scary Charts for Investors by JEFFREY KLEINTOP, Schwab, Oct 30, 2017

From the article:

Vanishing stocks

The number of companies listed in the U.S. stock markets has been cut in half over the past 20 years, going from 8,000 to about 4,000, as you can see in the chart below. The disappearing public stock market is a frightful prospect for active managers left with fewer stocks to pick from and investors concentrating more and more of their savings into fewer and fewer stocks.

Fortunately, this fear can be calmed by recognizing that the increasing number of non-U.S. stocks has more than offset the shrinking U.S. stock market. While there may be 4,000 fewer listed companies in the U.S. than 20 years ago, the number of non-U.S. listed companies has risen by 10,000 over the same period to about 27,000. (emphasis mine)

Jeff makes a good argument for international diversification. In addition to the traditional benefits of diversification going abroad also helps from the concentration risk in US stocks.