One of the very important factors for success with investing is the ability to build and own a diversified portfolio of various assets types. Simply owing only stocks for the long-run is highly risky. So it is better to own a combination of stocks, bonds, gold, real estate, etc. in a well-diversified portfolio.

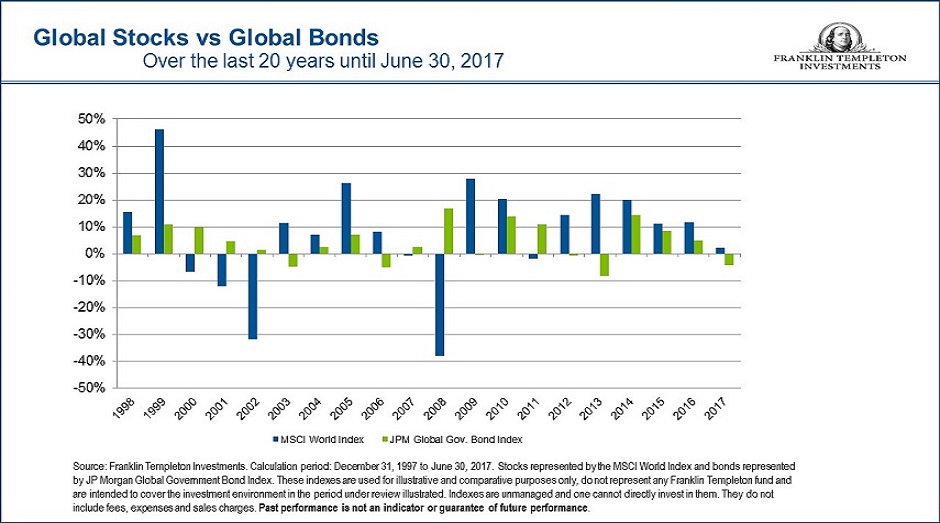

Stocks and bonds globally have moved in different directions over the past 20 years as shown in the chart below:

Click to enlarge

Source: Lessons Learned from the Global Financial Crisis, T. Anthony Coffey, CFA, Franklin Templeton Investments

The above chart shows that holding both stocks and bonds can offer stability and higher long-term growth. For example, in 2008 when stocks fell nearly 40% global bonds were up by over 15%.