Patience is one of the key factors that determines success in equity investing. Patience is especially important when markets are in a downward spiral due to any number of reasons. During bear markets it is extremely tempting for most investors to cut down the losses and sell out everything and move to cash. However it is one of the worst possible moves an investor can make. This is because they can miss out a violent rally when markets turn.

A recent article at Fidelity showed why it us important to remain invested during volatile markets. From the article:

It makes sense to own more stocks, but if market drops still make you nervous, remember this: It may be painful for a time, but if the stock market behaves as it has over long periods, you should be able to ride it out. This is why stocks should be owned for the long term. It has taken many years, even multiple decades, to recover from the worst historical declines in the stock market. But, overall, stocks still offer the most growth potential, by far—as long as you can stay the course over the long term.

Thinking of it this way may help, too: Losses are just on paper unless you sell your investments. If you are tempted to sell investments when they are down, remind yourself that you are investing for a time far in the future. So why lock in losses when you have time to ride the market back up? Also, if you save regularly and continue to invest during down markets (and the market demonstrates the kind of long-term growth that it has historically), you will be adding to your savings during those market dips, or “buying low.” When the market recovers, you may be even better positioned for growth.

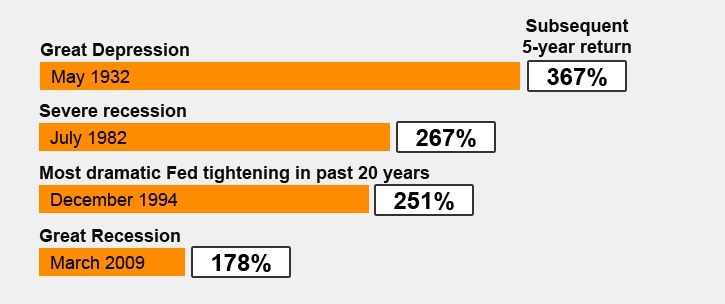

In fact, as the chart shows, what looked like some of the worst times to be in the stock market turned out to be the best times. The best five-year return in the U.S. stock market began in May 1932—in the midst of the Great Depression. The next best five-year period began in July 1982, when the U.S. economy was in one of its worst recessions.

Click to enlarge

Source: 3 reasons to invest in stocks, Fidelity

The key takeaway is to simply remain calm and be patient during market crashes. Selling out in panic is never a wise idea.