The dividend yield on the S&P 500 was 2.01% at the end of July. The yield has stayed around the 2% for many years now. This yield rate is low relative to other developed markets. In the US, investors and companies alike have a preference for share buybacks than dividends due to multitude of reasons. For instance, investors like to pay capital gains taxes when they sell stocks than paying taxes on dividends each year or quarter. Since capital gains are taxed more favorably than dividends this adds yet another incentive for investors to let companies keep profits as opposed to paying out dividends. Companies also prefer to hold on to profits instead of paying out to investors since they can plough back retained earnings to grow the company or deploy the capital to buy back own shares to goose up stock prices. Since stock options form a major portion of compensation especially to upper management, executing share buybacks all the time becomes even more important for companies. Another factor that favors buybacks over dividends is control. When cash goes out the door to investors’ pocket, the company loses control of that money.

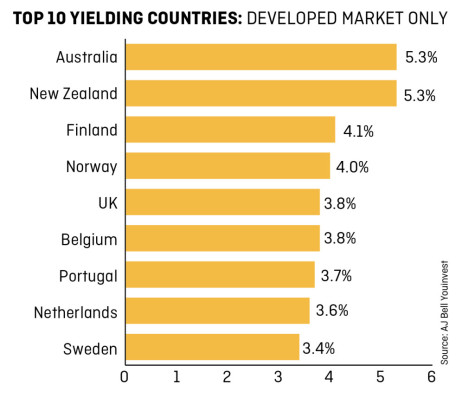

The chart below shows that much higher dividend yields can be found in other developed markets outside of the US:

Click to enlarge

Note: The rates shown above are as of July this year

Source: Where in the world are the highest dividend yields?, Shares Magazine UK

In summary, US investors can earn higher yields by going abroad. With plenty of options available to invest in foreign markets cheaply there is no reason to simply stick with domestic stocks.

How does Asx small to micro caps yields compare with average yields across the board?

That is a good question.Unfortunatetly I do not have the answer. Please do some research online.

-David