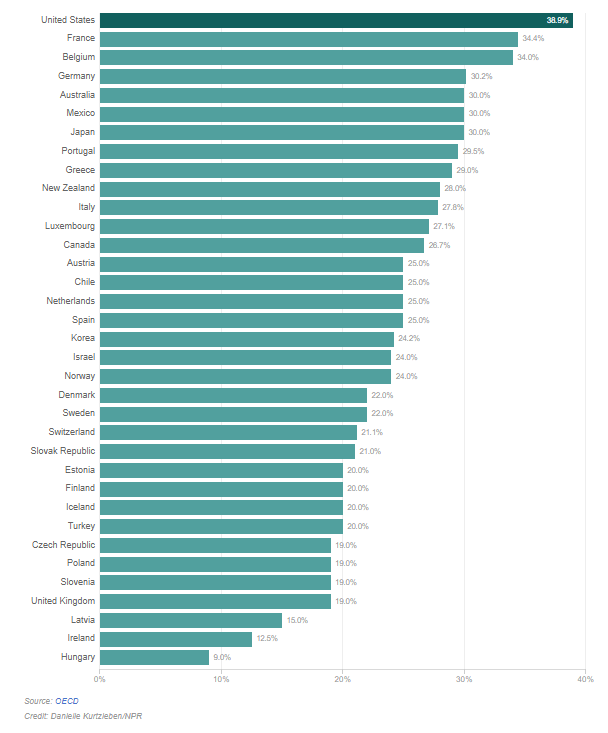

The US has the highest corporate taxes in the world. The current official rate of 35% is higher than even other developed socialist countries such as Scandinavian countries and France. The chart below shows the official corporate taxes by country according to OECD data:

Click to enlarge

Source: FACT CHECK: Does The U.S. Have The Highest Corporate Tax Rate In The World?, NPR

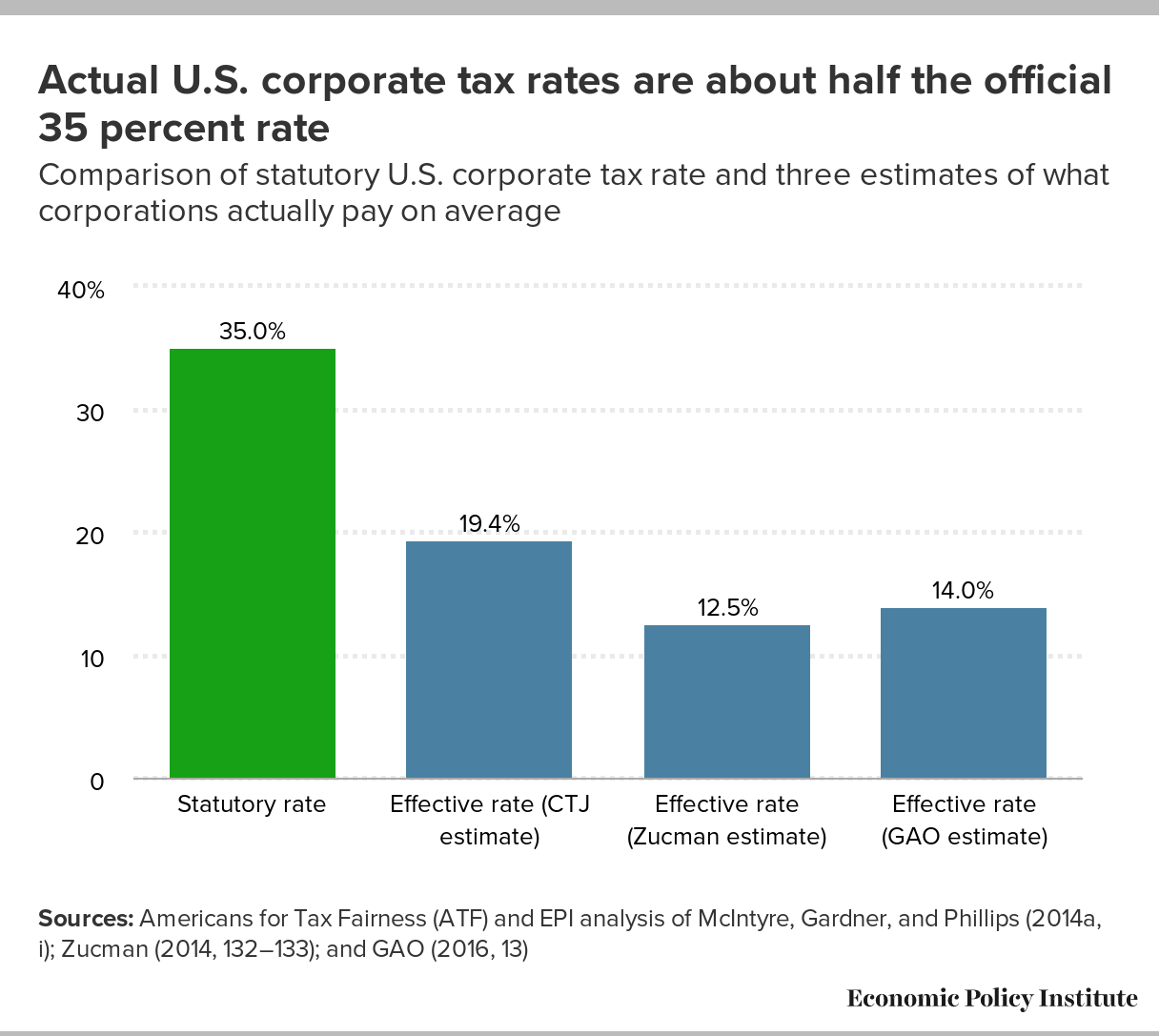

However the real tax rate that US companies pay is much lower based on analysis by various institutions. This is because corporations have a multitude of legal loopholes to avoid paying taxes. One such loophole is that profits earned overseas by US multinationals are not taxable as long as they are stashed overseas. So billions of dollars hoarded by multinationals abroad magically become non-taxable.

A report by EPI notes that the real US corporate tax rate that firms actually pay is somewhere between 13% and 19%.

Source: Corporations pay between 13 and 19 percent in federal taxes—far less than the 35 percent statutory tax rate, EPI