Equities offer the best returns over the long-term over other asset classes. For instance, stocks can yield inflation-beating returns. There are very few asset types that can yield returns that beat inflation.

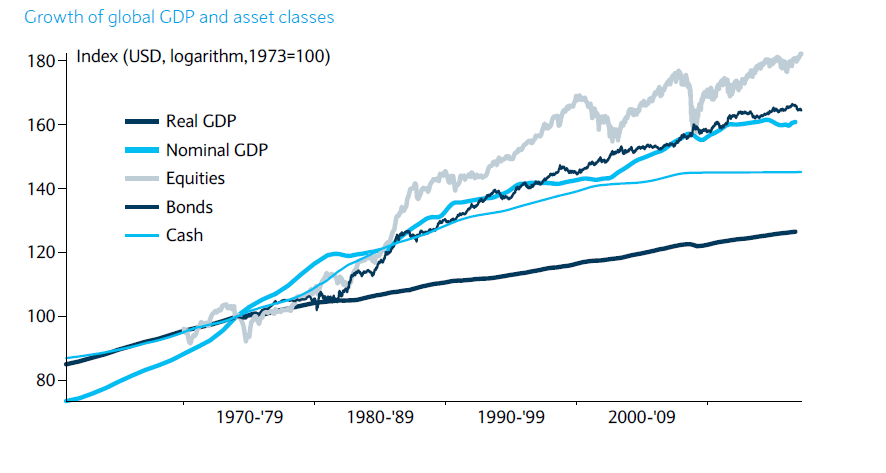

The chart below shows the long-term global GDP growth and the performance of various asset types. Stocks easily beat cash and bonds over the long-term.

Click to enlarge

Source: Datastream, Barclays. List of indices used: Equities MSCI World (USD) until 2001, MSCI AC World (USD) from 2001 onwards; Bonds Merrill Lynch US Treasury 7-10 years until 1980, Datastream

10 year US treasuries from 1980 onwards; Cash Federal Reserve US treasury bill 3 month

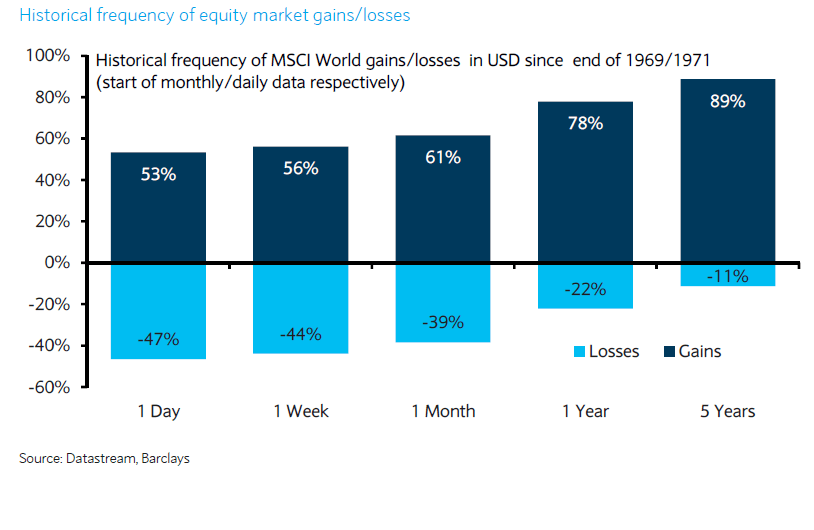

In addition, stocks have yielded positive returns more than 50% of the time in the long term. Stocks are the only asset class that can offer the best return over other asset classes over long periods.

Click to enlarge

Source: In Focus: Markets as we see them, Barclays

The main point to remember is that holding stocks in a well-diversified portfolio is important to earn higher returns over the long-term especially earning a high real return (which accounts for inflation) and not just nominal returns.