One of the many risks that investors have to take into consideration when investing in foreign stocks is Concentration Risk. This risk simply means a market is highly concentration with one stock accounting a large percentage of the allocation. Or to put it another way, one stock dominates the market. So a benchmark index that includes such a stock will he concentrated as well. Concentration risk can be a major negative factor to a market especially during adverse market conditions.

Among international equity markets some are more concentrated than others. In many markets sectors such as financials, utilities and resource companies may dominate the market.

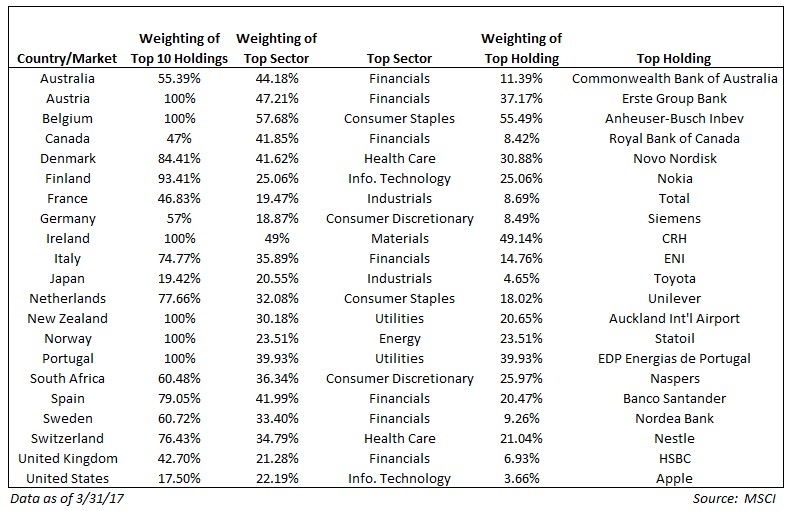

In order to identify how concentrated some equity markets are both in terms of sector and individual stocks, Lawrence Hamtil of Fortune Financial analyzed the MSCI index for countries that are included in the annual Credit Suisse Global Investment Returns Yearbook and included one table showing his findings. I find this table very interesting since it shows clearly how concentrated certain markets are when in fact investors may think otherwise.

Concentration of equity markets both by top holdings and sector:

Click to enlarge

Source: Relative Equity Valuations, Diversification, and Creative Destruction by Lawrence Hamtil of Fortune Financial

The US market as represented by the MSCI country index is dominated by the IT sector as it accounts for about 22% of the index.Apple(AAPL) alone accounts for about 4% of the IT allocation. The S&P 500 also is concentrated in this sector since it is a market cap weighted index.The good thing about the US market is that one sector does not account substantial part of the market. For example, the 22% weighting for IT pales in comparison to dominance by one sector in some other markets. In Belgium the consumer sector accounts for a staggering 58% while in Spain financials have a 42% weighting.

The top 10 holdings in Belgium amounts to about 56% of the index. Among the top 10 stocks, More results Anheuser Busch Inbev NV (BUD) alone takes up a 56% allocation. Similarly in Austria Erste Group Bank AG((EBKDY) accounts for 48% for 37% of the benchmark MSCI index. In Denmark drug Novo Nordisk(NVO) dominates the index with a 31% weighting.

The key takeaway from the above table is that concentration risk is one risk that investors need to be aware of and make their sector or country allocations accordingly. This is particularly important for country-specific ETF investors since the ETF may be based on the MSCI index for that country.

Finally the answer to my title question is an emphatic Yes. Some equity markets are very very concentrated.

Disclosure: Long EBKDY