The Top 50 blue-chip companies in the Eurozone are represented in the Euro Stoxx 50 Index. The Eurozone countries covered by this index are Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. For investors looking to gain exposure to developed Europe this index offers an excellent starting point for identifying potential investment opportunities.

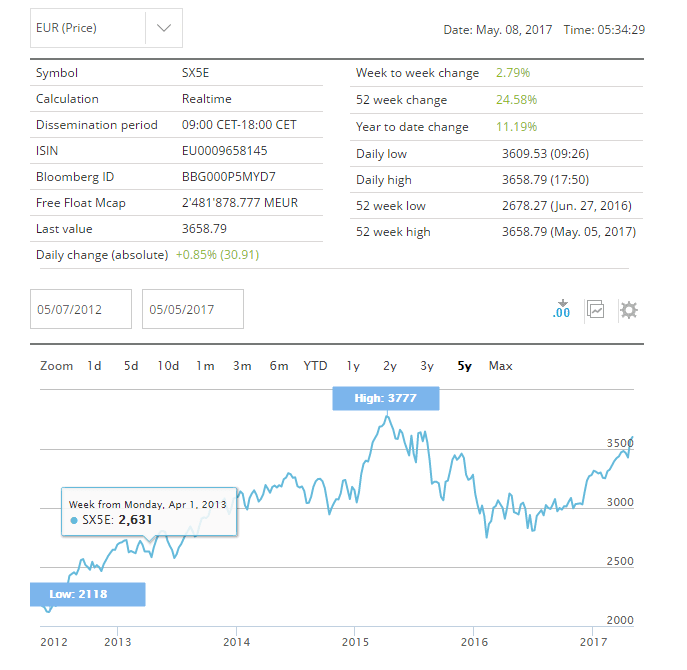

The Euro Stoxx Index is still below the long-term peak as shown in the chart below:

Click to enlarge

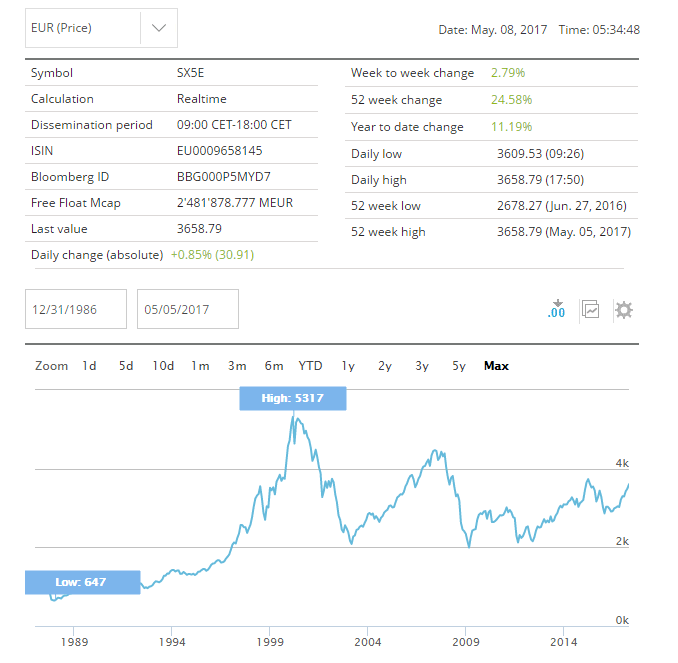

The following chart shows 5-Year performance of the index :

Note: Returns shown are for Euro-denominated price returns.

Source: Euro Stoxx

Ten stocks from the index are listed below with their current dividend yields for further research:

1.Company: Total SA (TOT)

Current Dividend Yield: 5.03%

Sector:Oil, Gas & Consumable Fuels

Country: France

2.Company: BASF SE (BASFY)

Current Dividend Yield: 3.21%

Sector: Chemicals

Country: Germany

3.Company: Siemens AG (SIEGY)

Current Dividend Yield: 2.64%

Sector:Industrial Conglomerates

Country: Germany

4.Company: Sanofi (SNY)

Current Dividend Yield: 3.21%

Sector: Pharmaceuticals

Country: France

5.Company: Banco Santander SA (SAN)

Current Dividend Yield: 3.41%

Sector: Commercial Banks

Country: Spain

6.Company: Unilever NV(UN)

Current Dividend Yield: 2.71%

Sector: Food Products

Country: The Netherlands

7.Company: Anheuser-Busch InBev SA/NV (BUD)

Current Dividend Yield: 3.17%

Sector: Beverages

Country: Belgium

8.Company: Allianz SE (AZSEY)

Current Dividend Yield: 4.16%

Sector:Insurance

Country: Germany

9.Company: Adidas AG (ADDYY)

Current Dividend Yield: 1.06%

Sector: Sportswear

Country: Germany

10.Company: Eni SpA (E)

Current Dividend :

Sector:Oil, Gas & Consumable Fuels

Country:Italy

Note: Dividend yields noted above are as of May 5, 2017. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Another simple way to gain exposure to the Eurozone blue-chips is via the SPDR® EURO STOXX 50® ETF (FEZ). Currently the fund has an asset base of over $3.4 billion and the expense ratio is 0.29%.

Disclosure: Long SAN