One of the topics that I have covered many times on this blog is the benefits of international diversification. No country or region is the top performing consistently year after year. So while the U.S. market has done well in recent years, over time other markets have been top perfomers in one year than the U.S.

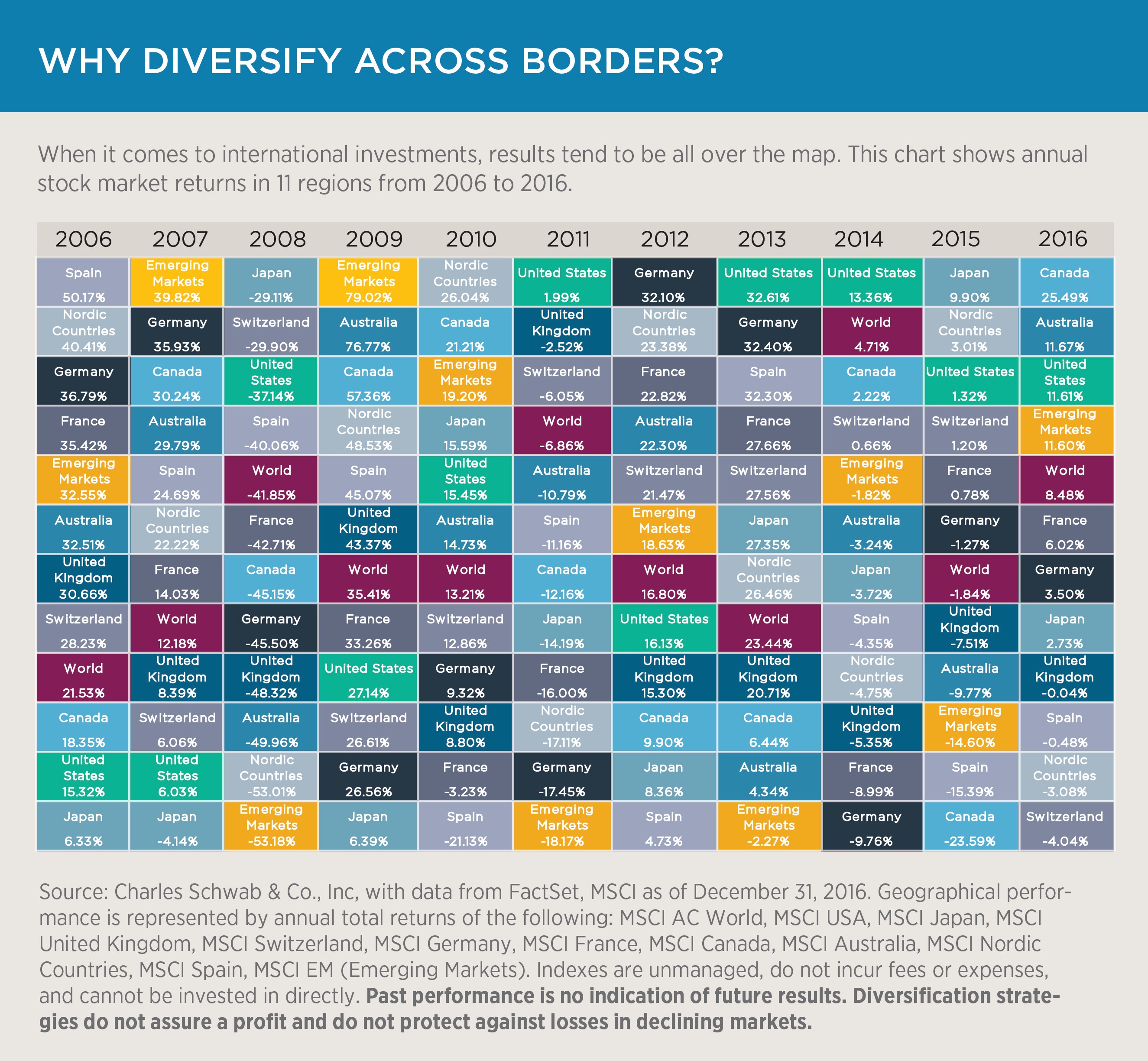

A popular tool that clearly shows the advantages of diversification is The Callan Periodic Table of Investment Returns. Recently I came across another chart from Schwab showing why diversification across borders is beneficial. The following chart displays the annual returns in 11 regions/countries from 2006 thru 2016:

Click to enlarge

Source: Why Global Diversification Matters, Schwab

Of the countries/regions shown above, Canada was the worst market in 2015 but was the best in 2016 when oil prices rebounded sharply. Similarly in 2012, German stocks returned 32% or double the returns when compared to US stocks (16%).

In addition, for the noted period the US market was the best performer only in 3 years.

So U.S. investors have to diversify their holdings globally in order to capture from the growth potential of other markets.